Extension Teams

I’ve been a big advocate of lowering costs by leveraging onshore, nearshore, and offshore extension teams. Onshore is purely for flex-capacity. But that lowers costs by not investing into full-time. Nearshore for us was Mexico and Brazil where extension teams were in our timezone. Offshore was mainly in the Ukraine and China with staff who could cover the markets abroad while corporate / US was sleeping.

How and when should you consider this model? First of all, we needed to hit our break-even goals by end of 2018. Thus, extension teams were important. But a big factor on whether you’re ready for this involves the fact that you need prior experience and relationships with partners – not to mention that you need staff who knows how to manage your remote resources. If you have those two things (partners & remote management core competency), the probability of success is higher. As an example, I knew the CEOs of our Ukraine, Mexico, and Brazil partner operations; and our VP of Engineering/CTO was a pro in managing extension teams.

2Q18 required optimization around our SI partner ecosystem. We worked hard to establish better training for our SI partners, and treat our extension teams like they were our own. They may have not been on our payroll…but other than that, we viewed these teams as part of the family.

Outsourcing = Leverage (Qtr 9 out of 11)

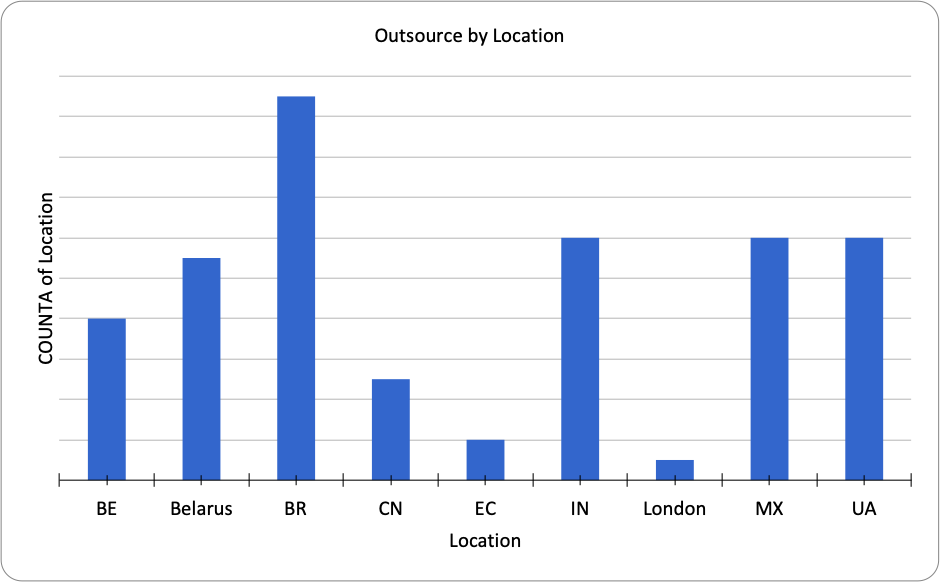

We had about 80 captured resources dedicated to Janrain in near-shore and off-shore regions of the world including:

- Belgium (BE)

- Belarus

- Brazil (BR)

- China (CN)

- India (IN)

- Mexico (MX)

- Ukraine (UA)

We also had about 20 captured resources in the US. This totaled approximately 100 people. We had about 125 full-time people for a total of 225 globally. That’s a significant amount of leverage and associated net lower-cost.

The example headcount by region above included partners such as CI&T in Brazil, Unosquare in Mexico, and Ciklum in the Ukraine.

Our QBR guest – A CISO Buyer Persona

For this QBR, I decided to invite the LBrands CISO, Patrick Reidy. It was a treat to discuss “how to sell to the security team” by talking to the top of the security food chain. Patrick was the LBrands CISO for 2.5 years, head of CSC (DXC) Cybersecurity for 1.5 years, the CSC (DXC) CISO for 1.5 years, and the US FBI CISO for 5 years – all-in-all, 25 years of security. We talked about:

- CISO’s Top Initiatives

- CISO’s search for Business Impact

- The Top 3 Messages for the CISO

- Current & Future State in Security

This provided the sales and CS teams a better view into their sales playbooks. Something I believed could really help finalize our messaging and complete our move from being a marketing-centric company to a true security-centric company.

2Q18 Playbooks

We unleashed the following playbooks in 2Q18:

- Top 3 Company Issues: Never fear, we always think about the cross-functional issues.

- Buyer’s Journey: Analyzing how our clients engaged our company and how many were involved from the first touch to then next renewal.

- Pricing & Packaging: Looking for ways to simplify our model even further.

- Professional Services Packaging: Were there ways to speed up delivery. Smaller starter packages which could be expanded/customized later?

- Support Packaging: Can we simplify even further? Three levels to two?

- HR Title Level Framework, Career Pathing, Staff vs. Market: The final package for staff – just in time for our August performance reviews. We nailed it.

- PS Delivery Issues Workshop: How do you incorporate an SDLC into your service projects?Should you? Does software development always belong in engineering?

- Sales Win/Loss Workshop: How do you get to 50% win rates?

- Alliance/Partner Strategy by Region: Tier 1, 2, and 3 by region of the world (if you’re selling globally). Certification and support.

- Content Creation Workshop: Time to distribute the job of content down to the individuals. How to incentivize more to become authors?

- Analyst Relations: Who and in what analyst groups? Awareness campaign?

- New Product Lifecycle Process: Time to roll out a Product Management process.

- CTO Office Priorities (Strategics, Key Prod Initiatives): Architecture is what helps scale the business

- More self-service – a new model: We needed to put more into the hands of clients to scale the business.

- Vertical Market Targeting Strategy and ABM List Refresh: Vertical selection helps narrow the search. Client targets by region by rep.

- Q1 Review & Q2 Spend Adjustments: Cash is the constant. Our monthly operations review feeds into this playbook where we look at all the “requests” for budget increases.

- Senior Team Objectives: Each senior exec aligns around a “Top 5”.

- Organizational 360: Never go a quarter without this. Peer reviews are powerful.

Top 3 Issues:

- Ability to provision quickly: This was a DevOps initiative that would allow us to further automate templated configurations, which could be customized after initial deployment – reducing time to deploy and time to revenue recognition.

- Self-service = scaling sales: We needed to prioritize new SaaS functionality that would not only differentiate the business, but allow clients to scale their application deployments faster, and without heavy professional services.

- Implementation Training: Time to create educational videos and core curriculum that will enable the channel, and empower our customers.

The Team

At this QBR event, we were at the Salishan on the coast of Oregon with access to a wonderful Lower Nature Conservancy Trail at Cascade Head. It was a marathon QBR, like most. This was the view on the third day.

Summary of quarters:

2Q16: Supercharging Your Leadership Team (Qtr 1 out of 11)

3Q16: Investing in Profitable Revenue (Qtr 2 out of 11)

4Q16: Making a Business “Repeatable” (Qtr 3 out of 11)

1Q17: The “aaS” Delivery Model (Qtr 4 out of 11)

2Q17: Compliance in the Cloud (Qtr 5 out of 11)

3Q17: Analytics in the Cloud (Qtr 6 out of 11)

4Q17: IoT affects All – Even Identity (Qtr 7 out of 11)

1Q18: Organizational Strategy (Qtr 8 out of 11)

2Q18: Extension Teams (Qtr 9 out of 11)