IoT affects All – Even Identity

It was 4Q17, and there was no way I was going to let the industry get ahead of us on “Identity of Things” (blockchain aside because that’s another discussion altogether). We had started servicing identity use cases for IoT devices back in 2011, partnering with Philips. By 4Q17 we were seven years into this, and almost two years into my additional investments supporting the IoT space. It was a part of our “innovation velocity” requiring our data & analytics products. We had four solid customer categories representing the future of things identity and how cloud authentication services could help automate and secure your things/devices. Those categories included the following with customer examples:

- Healthcare IoT with Phillips: over 50 different IP-connected products for which Janrain is providing simple registration/login services.

- Security IoT with Hager: IP-connected smoke alarms that is moving into security systems.

- Consumer Electronics IoT with Mars / Royal Canin: IP-connected pet devices.

- Communications/Media IoT with Freesat: IP-connected Satillite TV set-top-box.

We were so far ahead of our on-prem peers, like ForgeRock, who was investing quite a bit into the future of identity of things services with their on-prem identity suite. ForgeRock had, unfortunately, taken the Samsung ARTIK reference design and adopted their own proprietary approach using it. Why a group would link themselves to one of the many IoT hardware modules and associated device clouds was beyond me (note: ARTIK ended up closing down starting January 2019 with End-Of-Life targeted for November 2019). Janrain, unlike it’s competition, provided API-based software SDKs to its clients to embed its HW-agnostic services into any IoT device (we were friendly with HW solutions like Arduino and Raspberry Pi, as well with the AWS IoT Device SDK, the Azure IoT SDKs, Google Cloud IoT, IBM Watson IoT , ThingWorx Always On SDK, Salesforce IoT Cloud, Xively Platform, Zebra Zatar Cloud, GE Predix, and even open source platforms like the Kaa Platform, Macchina Platform, SiteWhere Platform, and ThingSpeak Platform). ForgeRock and Ping Identity didn’t have any “cloud DNA”. So both companies made some interesting moves, putting them well behind cloud-natives like Janrain (now Akamai), Okta, Onelogin, and Auth0. That being said, we were the only cloud-native actually delivering on IoT use cases at scale.

Investing into the Future of IoT with Identity (Qtr 7 out of 11)

“The Identity of Things (IDoT) is an area of endeavor that involves assigning unique identifiers (UID) with associated metadata to devices and objects (things), enabling them to connect and communicate effectively with other entities over the Internet.” TechTarget and WSO2 (Connected Identity: Benefits, Risks, and Challenges)

“I believe the IoT is forcing an inflection point in the industry that manages assets and user identities. It will generate a lively debate around the Identity of Things (maybe we’ll call it the IDoT, who knows) and ultimately will result in an updated view of identity management. Perhaps we will even see a day when the Identity of Things will evolve into a form of identity relationship management.” Earl Perkins (Gartner)

“Once one understands that global identity management cannot focus on users, but that attention has to be paid to all the entities making part of the system, the approach changes drastically. It is no longer necessary to manage only the identity of a person connected to an application or service, which is usually the case in IAM systems, but also of a user connected to a device, two interconnected devices, or a device and an application or a service. It is the new open, but secure ecosystem of the identity of the Identity of Things (IDoT), where all entities have the same interaction framework.” BBVA

“There is a need for Identity of Things (IDoT) management solutions to support communications between otherwise disparate IoT systems and networks. These solutions will evolve to include critical support functionality such as IDoT verification, permissions management, and discovery that will be provided by a combination of premise-based and cloud-based infrastructure.” Research & Markets Report “Identity of Things (IDoT) Market Outlook and Forecasts: Digital ID to play a Key Role in IoT Authentication & Security”

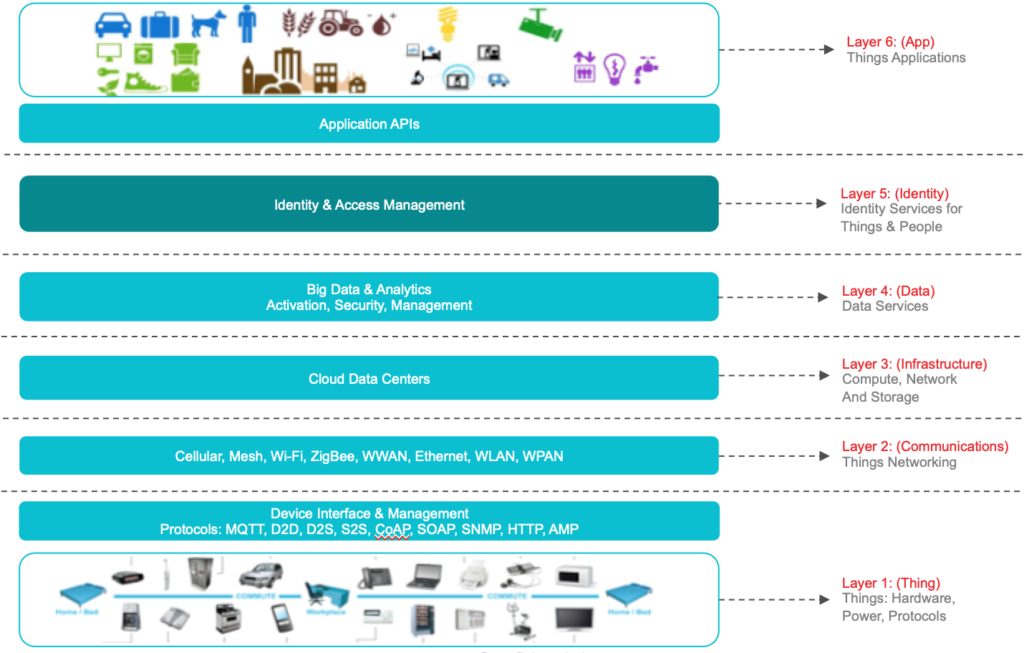

We looked at the entire landscape of IoT technologies whether we’re talking protocols, IoT application platforms, or the like (some interesting developments were occurring with PKI and Blockchain, and with many HW vendors – e.g. Intel’s EPID). Since there was so much going on, we wanted to bring in the experts. It never makes sense to think you can appreciate a landscape by yourself.

QBR Guests – Inviting the IoT Experts to Janrain

Danny Yu and Ken Forster are a couple of guys I trusted and more broadly the Momenta Partners team has been fantastic in being on the cutting edge of IoT. Ken and Danny and the team dug into a number of external research pieces (The Future of IoT in Enterprise – 2017, by Inmarsat Research Programme; Identity and Access Management for the Internet of Things – Summary Guidance, CSA; a number of reports by IDC analysts). My simple view of the IoT world was (and still is) represented in the graphic below.

As part of the planned exercise, we spent a day on the following:

- Janrain IDoT Use Case Overview

- Janrain Identity Cloud for IoT – Current State

- Momenta IoT Ecosystem Overview

- IDoT Ecosystem Analysis / Workshop

- Janrain IDoT Painted Pictures by Use Case

- IoT Strategy Workshop (Product Features, Partners, M&A)

Another area of external perspective came from the three HR sessions at Zappos that our VP of HR attended. See “The Team” event below.

4Q17 Playbooks

Other playbooks we unleashed in 4Q17 included the following:

- 2016a, 2017e, 2018p Reflections & Analysis: You have to set some pillars when you’re planning your next year budget. For example: 1) No New Funding: Using the cash we have, 2) Apply sensitivities with three variations of your plan = a) Target (e.g. sales quota), b) BOD plan (e.g. 20% off of target), c) Worst-case scenario = reduced spend plan (e.g. 40% off of target); 3) Additional investments that push out Cash Flow Break Even to mid 2018; 4) Year over Year growth on bookings of 40%; 5) No increase in bank debt; 6) No acquisitions of other companies.

- Painted Pictures (2018 – 2020): I held the end-year fixed so that we could simply leverage our last 5-year painted pictures, and then update. If someone asked me how I came up with my 5-year plan, it began with a painted picture exercise. I use my annual and quarterly annual themes and then add key metrics for each quarter.

- Finance Budget Analysis: This is a year-to-date analysis of the P&L that takes forecasts of bookings and DRR into account and analyzes “budget asks” for the quarter given the actuals. Its an extremely healthy exercise that forces execs to think about each other’s asks holistically. Ask my teams – they love it.

- Sales – Win/Loss Analysis: It’s much more than (Dollars Closed-Won) / (Dollars Closed-Won + Dollars Closed-Lost). It’s about understanding the details behind each loss and where it truly fits within categories like: 1) Product Feature/Function Deficiency 2) Deployment Concerns 3) Pricing Model/Levels 4) Experience in Industry / Use-Cases 5) Trust in team to execute (how well the sales team managed the process) 6) Customer References 7) Cloud Service Levels (Availability) 8) Demo/Orals (Did not “connect” with audience(s)) 9) Contract Terms (Issues with LOL, etc.)

- Alliances – Tech, ISV/VAR, GSI Strategy: When you analyze which SIs are supporting your clients with your solution, you’ll realize that people who you’ve never trained or certified might be representing you. We had a number of regional SIs being used to deliver our solutions. But then there were the many untrained client partners delivering our solutions, and a couple of strategics which we badly wanted to align our resources with. Strategy!!!

- Engineering/DevOps – Table Stakes: I had a “skunk” project where I asked my team to list ALL the things they have been wanted to get done that was constantly being back-burnered. Things that I categorized as “table stakes” – meaning that we absolutely needed them for our clients, but for a number of reasons were still on the “to do” list. Why? Because I wanted to go to my Board and increase spend by 50% in engineering, and knock this list out by end of 2018…which is what we did.

- Customer Success – DRR Turnaround: This was a repeat of the simple playbook – 1) What it will take to preserve GRR (gross retention) and 2) Increase Add-Ons for DRR. We needed to keep the pressure on that ultimately led to a future 90% GRR and 117% DRR.

- Technical Support – Developer’s Happiness: How do you provide the right level of “developer” support? It can be the most “draining” of your customer support / technical support resources. It can also be a force-multiplier since the developer communities are the largest within global 2K enterprises.

- Professional Services – On-demand Strategy: Our PS resources were still running “hot”. So we dug into 1) For Tier 1 account where we need to own the relationship, we would hire in support of the demand. 2) For Tier 1 where we are already invested with internal PS, we looked to transition PS demand over to a GSI only if they are “strategic” and we were fueling ecosystem growth, and 3) All other opportunities we leveraged an outsource model as needed.

- Privacy/Security – Itemizing Capabilities of Security, Privacy, & Governance: We dug into 1) Data Privacy (Providing consent on use) 2) Data Governance (Enforcing policy for the permitted purpose, or use) and 3) Data Security (Protecting access to our clients most important asset – their consumer data). We were beginning to package what we referred to as our “SecureEdge” offering. It was time.

- Product – Competitive Positioning for Sales: We continued to apply playbooks to overcome the obstacles of “feature selling” and cracking the code with “solution selling” that involves key differentiators.

- Marketing Website Upgrade and Associated Messaging: Ever plan and execute a complete overhaul of your website and deliver it within two quarters? We did.

- EU Region – Growth Accelerators: I wanted the EU to grow faster than the US. It was time to assess whether to double-down. FYI, we ended up putting the “peddle to the metal”, leveraging our happy customer base. EMEA first-year-bookings grew to be 105.2% of BOD Plan in 2018; EMEA ARR Bookings ended at 135% of BOD Plan at a 59% YoY growth!!; and EMEA DRR ended at a blistering 140.09%!!! Our playbook/plan worked.

- The Strategy for Strategics: Who to align more strongly with as technology partners that could create 1+1=5.

- HR – Recruiting Analysis: We dug into things like 1) Overview of YTD 2017 Recruiting Fees 2) Success of Hires 2016-2017 3) What can we do better in Talent Acquisition? What is working and what is not? 4) Are we willing to invest in a Technical Recruiter in house to handle all initial screening and LinkedIn sourcing?

- Marketing Lead-Gen Review (Mrktg, Alliance, Sales):

- Team Objectives Exercise – Top 5: This is the cornerstone playbook for senior team alignment every quarter. How to use it as a communication package for all the company.

- Senior Team 360: Performance vs. Potential as perceived by your peers. You’re not allowed to speak, only listen and say, “thank you”.

4Q17 Top 3 Issues

- Pipeline: The sales team was screaming for change.

- Gross Churn: This didn’t get solved in 3Q17. In addition, we were “firing” bad customers.

- PS Delivery: As sales did begin to ramp, we knew delivering what we sold was going to be an issue. We needed to improve internal professional services as well as ramp our delivery partners more.

The Team

This was my last sponsored visit to Zappos – the experts at delivering happiness. Tony Hsieh, co-found and CEO of Zappos, had been so kind to personally host past teams for a private dinner and special tour of his phenomenal team at Zappos….but Amazon had finally put a kabash on letting us roam around the live call-center due to regulations. I did send my VP of HR to some 1:1 sessions with his team on culture, recruiting, and employee relations). Ask any of my HR execs from the past…this was a treat. Janrain was my third visit to Zappos, always with the intention of super-charging my company culture.

Summary of quarters:

2Q16: Supercharging Your Leadership Team (Qtr 1 out of 11)

3Q16: Investing in Profitable Revenue (Qtr 2 out of 11)

4Q16: Making a Business “Repeatable” (Qtr 3 out of 11)

1Q17: The “aaS” Delivery Model (Qtr 4 out of 11)

2Q17: Compliance in the Cloud (Qtr 5 out of 11)

3Q17: Analytics in the Cloud (Qtr 6 out of 11)

4Q17: IoT affects All – Even Identity (Qtr 7 out of 11)

1Q18: Organizational Strategy (Qtr 8 out of 11)

2Q18: Extension Teams (Qtr 9 out of 11)