When should you scale sales?

I was talking recently to a Board member of an emerging high-growth startup. The topic was around growth. He had scaled his company from $0 to $1.3B in revenue – so you could say that he has experience with the concept. The question is always about when and how to invest in scaling your business. The senior team will have inflection points in the business that will help determine actions for growth – generally, is the business predicable enough to increase marketing and sales spend, knowing that you get $X in revenue for every tranche of $Y investment in Z timeframe.

If you’re a SaaS company, is it when you achieve a CAC (customer acquisition costs) equal to $1.00? Is it when you have reduced your sales cycle to 3 months? Is it when the win rates are >50%? Is it when marketing, channel, and direct sales lead-gen optimization has achieved a cost per SQL that is <5% of your ACV? Is it when you consistently maintain a qualified pipeline that is =>5x than your targets (note: even though you should only need 2x with a 50% close rate)? Is it when you are able to on-board new sales pods within 3 months and achieve full ramp within 6 months? Is it when sales attainment at full ramp is >80%? Is it when your forecast accuracy is within 5% comparing the beginning of the quarter forecast to actual? You get the point. It’s not an answer to just one of these questions but, obviously, a combination.

Putting the pedal to the metal on sales (Qtr 10 out 11)

I am always amazed when I listen to how some of my peer CEOs and their sales teams manage their business. When you ask them what their goals are for the year, you may get a clear answer: “$25M”. But when you double-click into the sales strategy and plan behind the target, the details aren’t there. How many reps fully off ramp in Q1, Q2, Q3, Q4? What attainment are you assuming to achieve that $25M? What rep attrition did you plan for? I think hope and dreams are the basis of some of my peers.

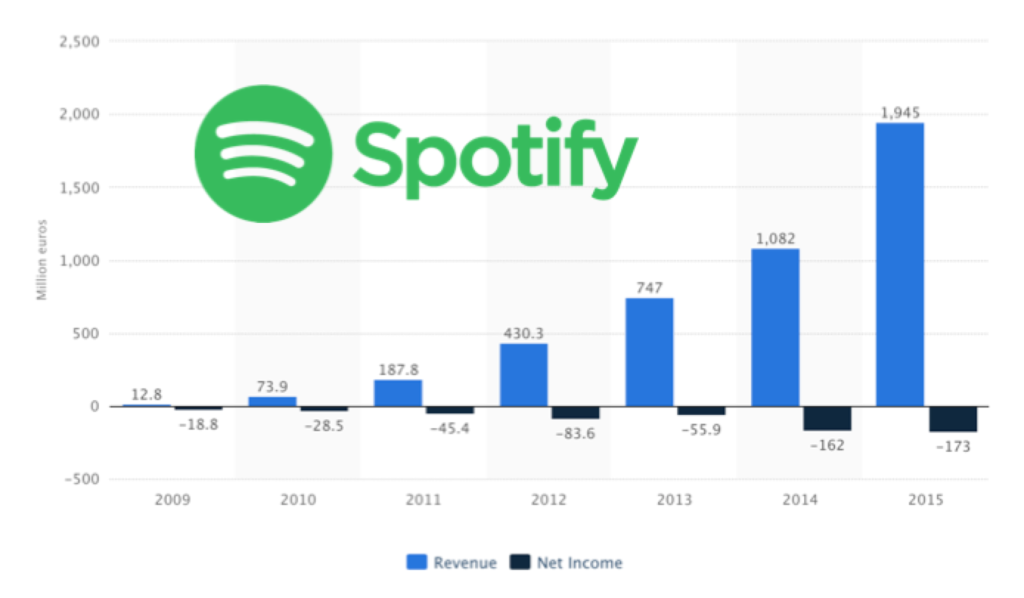

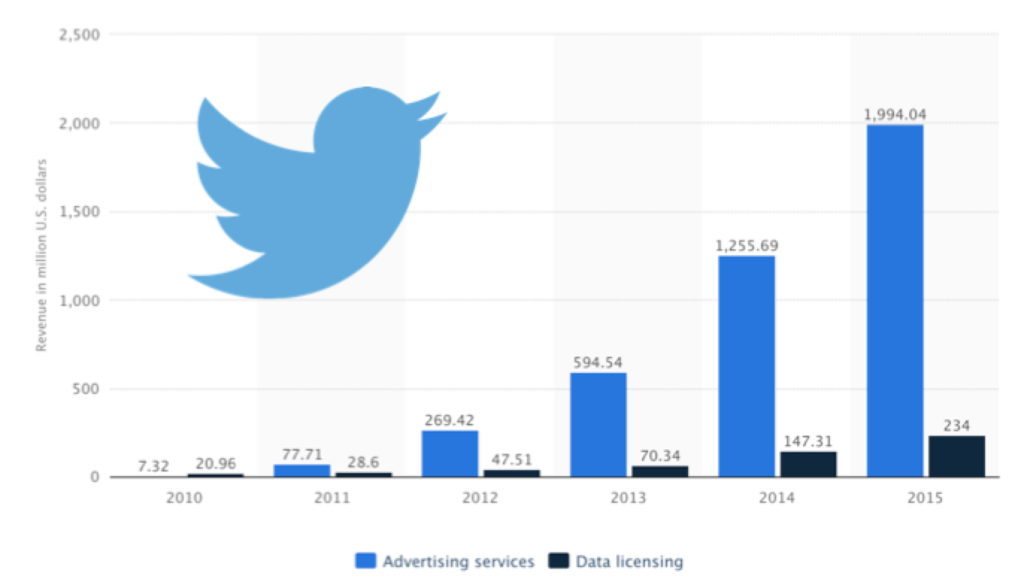

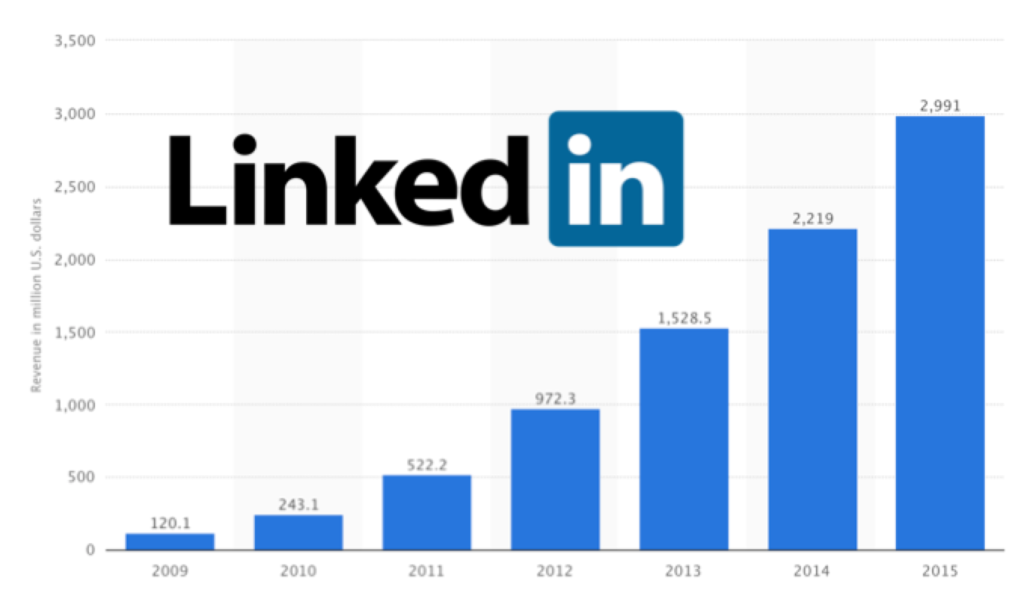

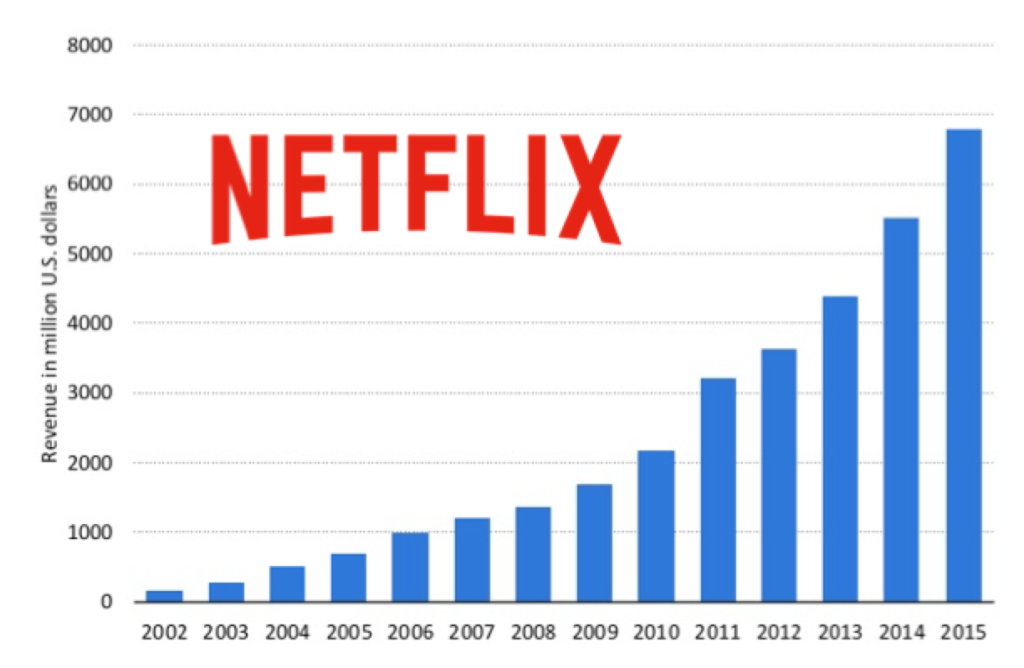

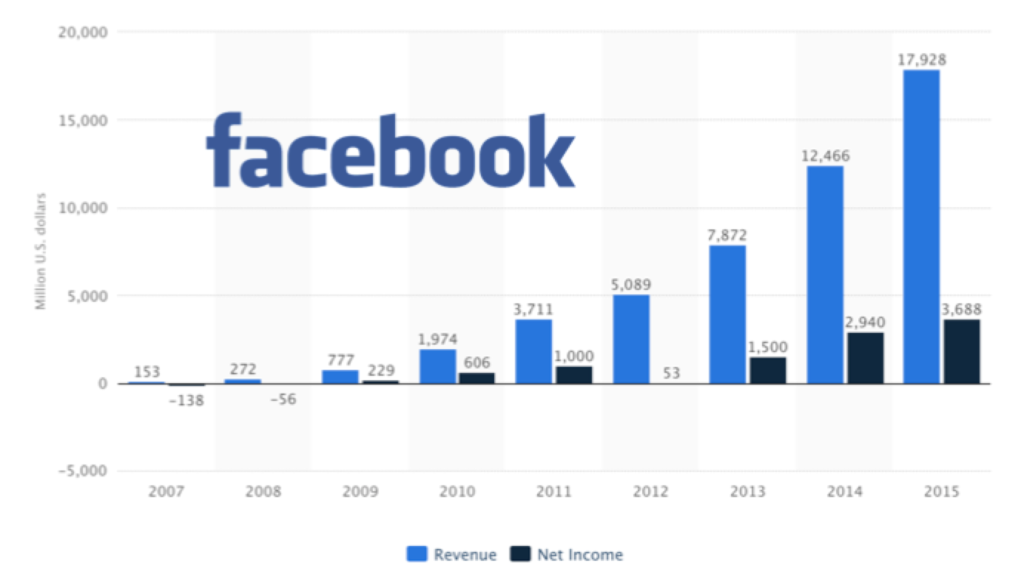

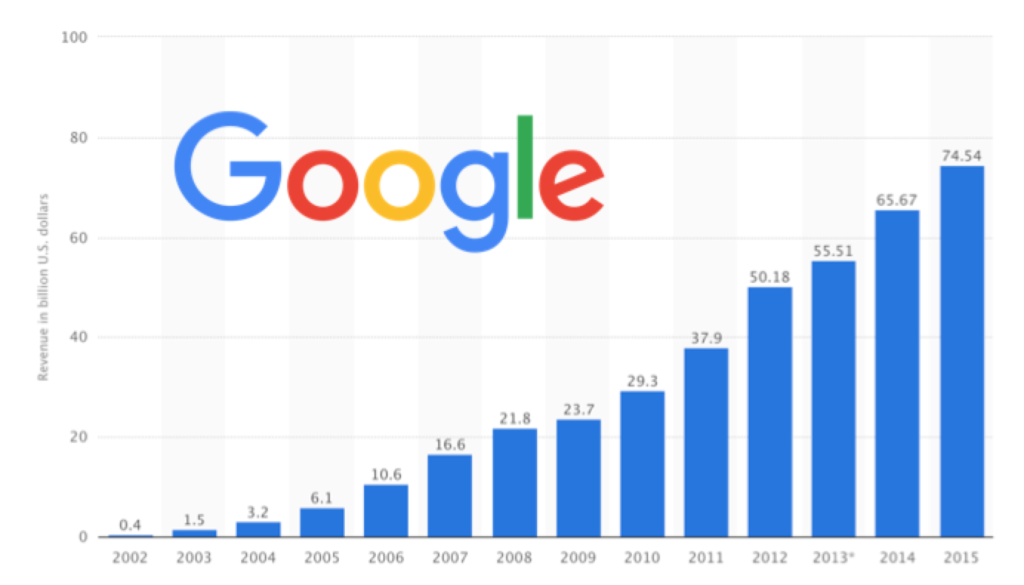

Everyone wants a non-linear ramp with 3x+ growth year over year. Lets just look at a few webscale company examples:

Easy enough to find examples of what you’d like to model. But what does a growth-centric senior team need to do to achieve this? How much trial and error – how many playbooks before you get it right?

Easy enough to find examples of what you’d like to model. But what does a growth-centric senior team need to do to achieve this? How much trial and error – how many playbooks before you get it right?

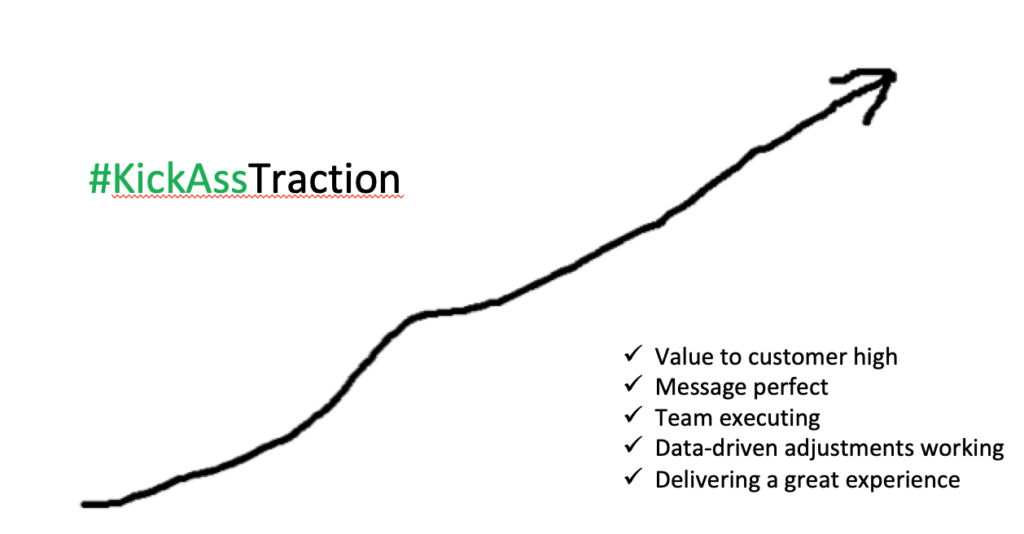

- Delivering value (ROI) to your customers?

- Have the perfect marketing/sales message?

- Achieving sales team execution?

- Are metrics are being tracked and optimized constantly?

- Delivering a great customer experience (pre to post sale)?

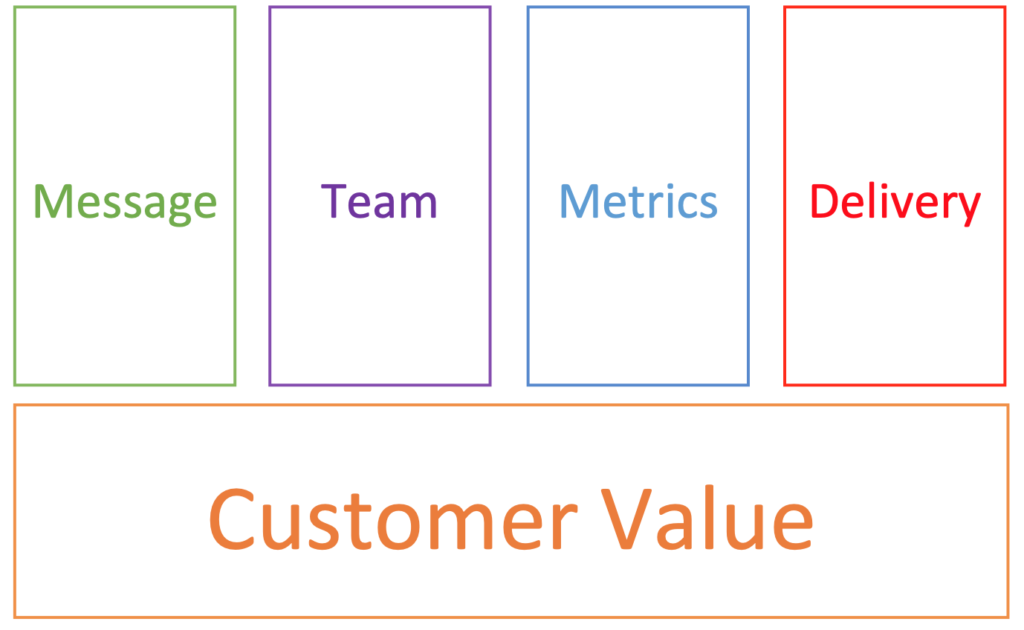

This is my oversimplified model for growth.

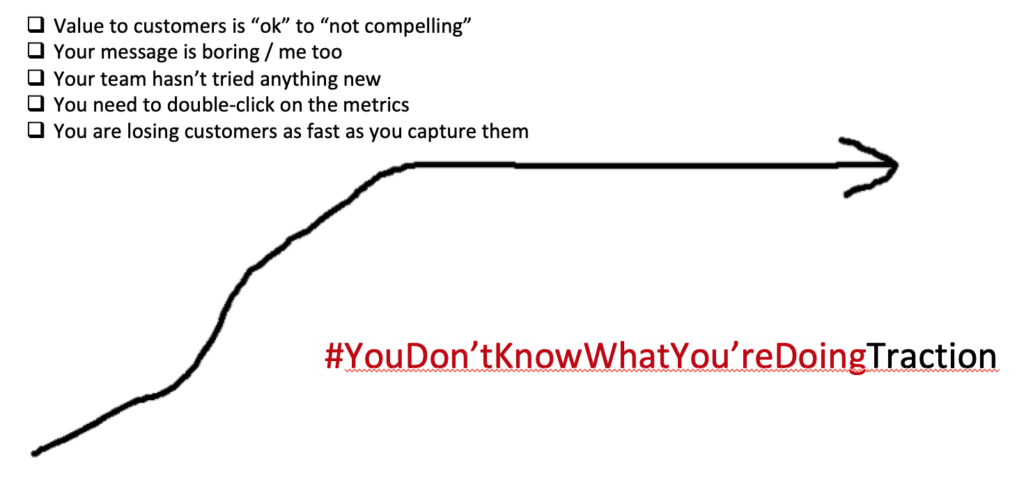

Your revenue plateaus, of course, when you experience inefficiencies. This has been the profile for my last four companies/businesses I was invited into.

Your revenue plateaus, of course, when you experience inefficiencies. This has been the profile for my last four companies/businesses I was invited into. With a little less luck, you’ll rise to a certain revenue milestone only to find out that performance is lumpy at best, or a rollercoaster worst case.

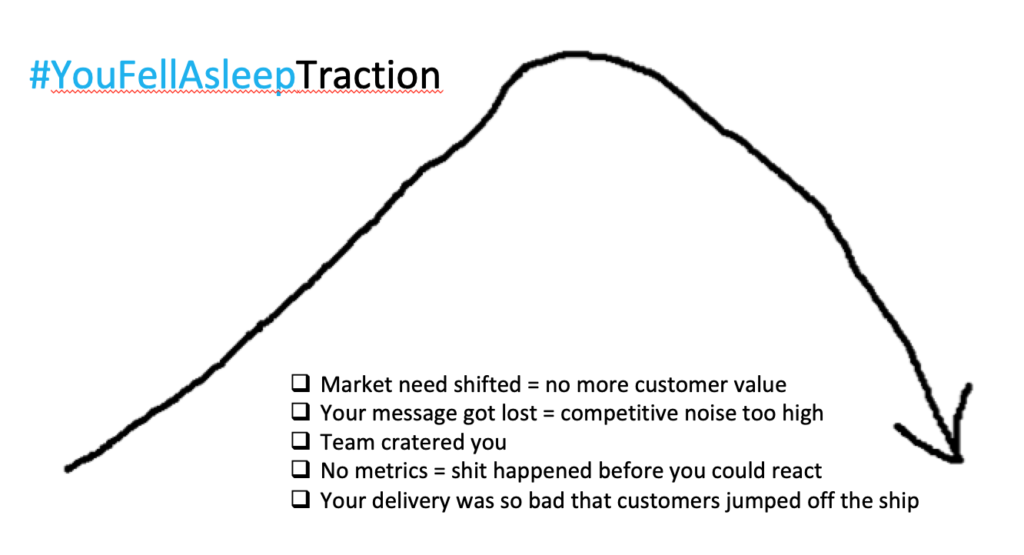

With a little less luck, you’ll rise to a certain revenue milestone only to find out that performance is lumpy at best, or a rollercoaster worst case.

Then I’ve seen companies that have invested an incredible amount of capital only to find that they have never gotten off the ground (this usually means it was an engineering lab experiment).

Then I’ve seen companies that have invested an incredible amount of capital only to find that they have never gotten off the ground (this usually means it was an engineering lab experiment).

3Q18 Playbooks

Here’s a snapshot of some of our 3Q18 playbooks:

- EU Business Review: This was a mid-year review where we dug into the entire P&L for Europe with key objectives for every business function within the region.

- Alliances 2019 Strategy: We needed to prepare for our partner-centric strategy in 2019. This meant getting our hiring plan flushed out well ahead of 4Q’s budgeting process because we knew we needed to put things into motion in 3Q that would result in action in 4Q (e.g. we budgeted for an alliance team investment for 4Q).

- Marketing Analyst Strategy: It was time to invest more in our analyst community. This meant Gartner, Forrester, KuppingerCole, TechVision, IDC, Ovum, Altimeter, and Aberdeen.

- HR Market Comp Analysis & Equality Adjustments: We were rolling out a complete compensation normalization in August to account for equality of pay regulations.

- Security Risk Register: We wanted to revisit our ISMC approach to risk governance. We hired the CISO for Circle-K and we asked for some disruptive thinking on how to reduce risk.

- Product Top 5 by Product Area: It was time to review roadmaps for each area of our solution-set. This involved five PM directors/managers as well. The goal in the Product organization is to achieve transparency of where development is (for the current quarter), what is coming down the pipe (aka the next quarter), and how our 12 month roadmap is adjusting (due to priorities and customer asks).

- Product Self-Service: We wanted to continue to put pressure on the team to remove friction in the use of our SaaS platform.

- Prod/Eng/PS Application Development: This was a detailed view how to “productize” our customer integrations. Every new customer logo resulted in a potential “snowflake” or customized integration (what’s your approach to connecting to the mainframe?). We needed a way to deliver new integrations within our SDLC, but without turning engineering into PS.

- Sales Top 20 Performance (AE Target Lists): Time to review and adjust our sales team’s contributions to SQL lead-gen (25% of our target leads).

- Finance Budget Asks, 1H Performance, 2H Budget: Mid-year snapshot. We wanted to assess where we were on hitting break-even by end-of-year.

- Identity Companies Review: It’s healthy to gather as many statistics on our peers. It’s a great task for our PE team resources.

- Top 3 Issue Processing: A standard quarterly process to align the entire team behind the company’s big issues.

- Q3 Objectives: It sometimes results in debate, but it always results in alignment. What is each executive focusing on within their organization this quarter (it better align to the company’s Top 3).

- Team 360: How are we doing as a team. Time to dig into what’s working and what needs help.

QBR – Two Guests to Supercharge the Business

We invited Mark Danaher to help with our EU business planning and execution. At this QBR Mark and our EU Managing Director presented their work. The team discussed:

- EU Offerings (localizing our North America solutions)

- EU Deliver Model

- EU Customer Success

- EU Professional Services

- EU Alliances

- EU Sales & Marketing

- EU HR/Organizational Structure

We also invited the Topo Group (Eric Wittlake) to assist in our marketing benchmark targets, adjustments required to hit those targets, and a management system to monitor and optimize – it’s “Gartner” (aka benchmarks) + “McKinsey” (aka change management) for marketing and sales. We started the discussion by reviewing the PacCrest/KeyBanc SaaS survey/benchmark data (which was recently updated). We then dug into all our marketing and sales metrics (things like CAC and LTV/CAC). Then we dug into tactical recommendations (e.g. tightening MQL scoring, MQL definitions, inbound vs. outbound lead qualification, etc.).

Top 3 Business Issues

- Partner Access to our SaaS admin systems: This was an engineering/infosec challenge.

- Partner Training Materials: Our training director needed more support/budget to accelerate this.

- Self-Service Feature Release to Customers/Partners: We were awaiting the launch of a new SaaS module we labeled as “Hosted Login”.

The Team

Seventh Mountain River Company helped us raft the Deschutes. This was an absolute favorite for the team.

Side Thoughts

There are a few frameworks teams can use to support their decision to put the “peddle to the metal” with sales.

Our team was very mindful of our marketing messaging (we went through two iterations of messaging work in 3 years), the structure and quality of our sales team (SDRs, AEs, and CSMs) with associated compensation/incentive structure, the marketing and sales metrics, and how we delivered what we sold (which led to higher retention and expansion). But at the end of the day, we quantified, improved, and referenced customer value in order to drive our performance higher and higher.

Summary of quarters:

2Q16: Supercharging Your Leadership Team (Qtr 1 out of 11)

3Q16: Investing in Profitable Revenue (Qtr 2 out of 11)

4Q16: Making a Business “Repeatable” (Qtr 3 out of 11)

1Q17: The “aaS” Delivery Model (Qtr 4 out of 11)

2Q17: Compliance in the Cloud (Qtr 5 out of 11)

3Q17: Analytics in the Cloud (Qtr 6 out of 11)

4Q17: IoT affects All – Even Identity (Qtr 7 out of 11)

1Q18: Organizational Strategy (Qtr 8 out of 11)

2Q18: Extension Teams (Qtr 9 out of 11)