Making a Business “Repeatable”

It’s actually a great theme (“repeatability”) for a team that isn’t used to being data-driven. Before I even started at my last company, Janrain, I sent an introduction email to each of my soon-to-be executive team members, requesting four simple items. Here’s what I wrote:

I need your help to get me started with four things – that I’d like you to ponder and share with me between now and Monday EOD:

1. What are the top 5-10 things you want to accomplish this quarter (2Q) personally. Think of these as your “go gets” that you’d really be excited to have achieved by the end of 2Q.

2. What is your current weekly/monthly meeting schedule…what recurring meetings do you have that are your own, that you host for yourself/your staff that you can share with me. I need to understand the team’s calendar as I create my new management system. You don’t have to include any meetings which you “attend” that others host. Please share title/days/times/length.

3. What are the key metrics / KPIs that you’d distill out of your dashboards that you PERSONALLY have at the “top of your list”. 5-10 metrics.

4. Give me your “Top 5” issues for this quarter that you feel MUST be fixed. I know there are many opportunities, but distill into your most important 😉

It was quite easy to expand my #3 request above into what later became the executive team’s KPI Dashboard. It was top of mind for me, and would immediately become top of mind for the entire company.

Our 5 year plan

We created annual and quarterly themes for 5 years out, in order to establish a “roadmap” for the entire company to follow. It was, in fact, providing the guide for all the change we were architecting. And it was my way of being in every meeting, every hallway discussion, participating in every decision…not physically, but virtually by giving the staff a roadmap for the business’ transformation.

Proving our “Repeatability” (Qtr 3 out of 11)

It was the my third quarter on the job (out of 11), but it was the fourth calendar quarter for the business. Our annual theme needed to align with the Q4 theme, because it was now or never. For review, I had established the following quarterly themes and associated messages (straight from materials shared with the staff):

- Q1: Setting the “HighBar” – HighBar is more than a PE investor. They are an extension of our team and have the resources to assist us in being successful. This quarter has been about HighBar and Janrain setting the basis for a long-term partnership.

- Q2: Taking the “Tribalry Summit” – This is about leadership – starting with the senior team learning how to take the more difficult paths, challenging ourselves to do things differently, and preparing ourselves for the change needed to fuel our growth.

- Q3: Investing in “Profitable Revenue” – This quarter is about not only continuing our investment in our Sales and Marketing model, but proving that it will result in profitable growth.

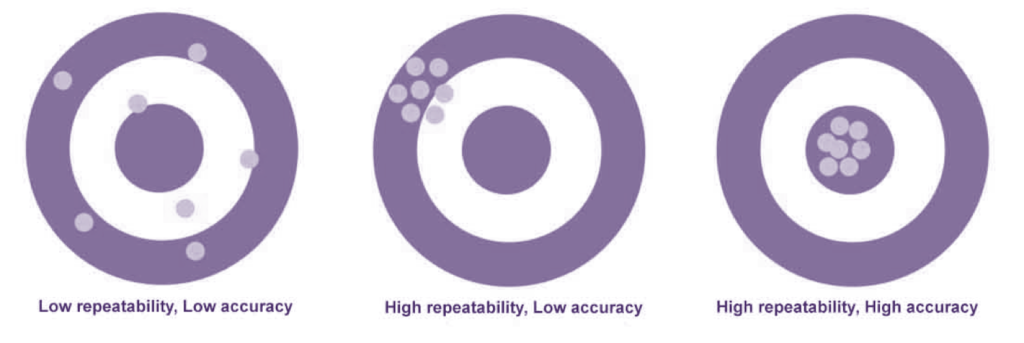

- Q4: Proving our “Repeatability” – By the end of 2016 we need to achieve repeatability across ALL parts of our business, from engineering, to delivery, to sales and marketing with clear, measurable metrics. This will be a must-have, entering into 2017.

4Q16 Playbooks

The following were the playbooks we unleashed in this quarter:

- Strategic Planning w/ a Painted Picture: We envisioned what the company would look like at $100M for each department and then worked backwards. We used three guiding principals that I delivered in the form of well-known cliches: 1) Leaders won’t have all the right answers, but they need to ask the right questions; 2) “If the rate of change on the outside exceeds the rate of change on the inside, then the end is near”Jack Welch GE; 3) Visualize first. Then Plan

- Top 3 Issues Processing (from Sales): Doing a workshop with the entire sales team on top issues and putting all the senior team behind action plans.

- Use of Funds (out of cycle): When, where, and how to invest more than what’s in the original budget. An exercise to challenge the status quo.

- Marketing Strategy for a Path to Pipe (Regions, Industries, Offerings): Using Topo‘s marketing benchmarks to really hone in on areas to improve. We wanted a 5x improvement in pipeline overall. This required significant enhancements to our messaging, competitive positioning, optimized paths to our customers and ultimately an increase in conversion rates across the engagement lifecycle, reduced sales cycles, etc.

- Sales Strategy with A New Organizational Model: We created a POD model that was arranged by regions, moving to a more combined target and compensation.

- Product Strategy by Breaking down the Roadmap: I wanted the team to segment our roadmap into specific areas and focus on one area at a time. For example, at Janrain we wanted an “Identity Data and Analytics” roadmap.

- Professional Services Strategy with New Offerings: This was a playbook workshop to help define our service offerings

- Customer Support Strategy with Extended Team: This involved a playbook on how to extend Janrain’s support with partners to achieve the right global coverage. There is also a heavy component of analyzing where customer support comes from (aka engineering, professional services, customer success, and then actual technical support people dedicated to the function).

- Customer Success Strategy for Higher DRR: I laid down the goals for DRR by end of 2017 and 2018. We then initiated a workshop to achieve those goals.

- Alliances Strategy a Year In Advance: A standard playbook for a SaaS company is to identify the right type, number, and timing for the indirect sales channel. We needed a strategy for global delivery coverage as well as an indirect sales G2M. The plan was to start this process, knowing that it would take all of 2017 to establish the right strategic partner relationships.

- Pricing Strategy with Bundles: We needed to roll out new bundles of SaaS subscription, Support, Pro Serve to the sales team. We came up with four bundles – two that were land and expand for “small” accounts, and two that were effectively “medium” and “large” offerings that we spent 90% of our energy on.

- DevOps Strategy for a Global SaaS Footprint (by Region): Some SaaS providers have it easy where they can deploy out of a minimal set of cloud regions to serve their clients globally. We were not so lucky. So we needed a clear strategy on cloud infrastructure investments.

- Security, Privacy, GRC Strategy and How to Package: Security became our focus and privacy/compliance a byproduct of heavier regulations. There was a clear playbook on how to begin leveraging our position better in marketing and sales positioning.

- HR Strategy & Building our Pools: Knowing that Janrain would require a significant investment in A-team capabilities. We needed playbooks for recruiting (getting the right talent in our pipeline), effective interviewing, repeatable/scalable onboarding. In this workshop we asked three key questions: 1) Do we have the right mix of resources across the functional groups? Aka how do we compare to other companies of similar revenue? 2) How do we correct our staff maturity level? We have many “junior” staff members who don’t have the skills to address the enterprise challenges faced by our company. and 3) We’re going to lose some of our top quartile staff. How do we make sure we’re ready to quickly backfill?

- Corp Dev Strategy around Inorganic Growth: We ended up looking at 30 companies, 3 of which we approached to buy. Companies need to look at their core, but also consider adjacencies and potentially game-changing/disruptive moves.

- Finance By the Metrics: This was the beginning of our corporate dashboard, which we completed by end of 2016. Some use ERP systems, we used google sheets and Geckoboard.

- Staff 360: My Staff 360 hasn’t changed much over a decade. We looked at performance vs. potential for each executive team member. All senior team was ranked on a 9-cell matrix by each other (including me, of course) and open dialog/discussion ensued. Without this, you don’t make the corrections in behavior, changes in team, and ultimately negative energy will build up. This playbook has to be one of my most powerful because it has been the most effective release valve, self-reflection & improvement, and peer alignment tool I’ve ever used.

- Budgeting: How do you take what’s in your “painted picture” and realize a budget that both your team and the board can approve. This takes a whole quarter to complete, one Board prep meeting, and a final Board approval meeting.

- Team Objectives Exercise – Top 5: This is the cornerstone playbook for senior team alignment every quarter. How to use it as a communication package for all the company.

Our QBR Guest – Changing Our Sales Strategy / G2M

I invited Bob Gregoire, a sales strategist and Sandler executive coach, to help us think about our sales model on three axis: Attitude, Technique, and Behavior.

4Q16 Top 3 Issues

- Lead-Gen: Not enough pipeline from our SDRs, after our shift to the high-end. How to accelerate across all regions.

- Marketing: A much-needed team “reboot” with a clear focus on market awareness / thought leadership.

- Documentation: The only way to automate delivery is going to be through detailed documentation on our SaaS offering.

The Team

Everyone (except one) got out into the surf with Club Ed. That’s my Donald Takayama surfboard at sunrise with the team – a board which you may have noticed later in pictures of my desk – it was how you knew where I sat (or stood) at the office.

Summary of quarters:

2Q16: Supercharging Your Leadership Team (Qtr 1 out of 11)

3Q16: Investing in Profitable Revenue (Qtr 2 out of 11)

4Q16: Making a Business “Repeatable” (Qtr 3 out of 11)

1Q17: The “aaS” Delivery Model (Qtr 4 out of 11)

2Q17: Compliance in the Cloud (Qtr 5 out of 11)

3Q17: Analytics in the Cloud (Qtr 6 out of 11)

4Q17: IoT affects All – Even Identity (Qtr 7 out of 11)

1Q18: Organizational Strategy (Qtr 8 out of 11)

2Q18: Extension Teams (Qtr 9 out of 11)