New Cloud Ecosystem

I was touring what reminded me of the Cheyenne Mountain nuclear bunker – one of the safest places on earth. Except in this case, this was one of the safest places for your enterprise data on earth.

“The entrance will open, you will drive in, and an armed guard will be out to escort you.” That was the beginning of my tour of a Tier 4 datacenter, furthest from any natural disaster. 100% guaranteed up time.

I was staking out where we would launch our newest version of the Infochimps Big Data cloud service – our enterprise cloud service would soon be launched in the most trusted datacenter in the world, along side the largest enterprise data installations in the world.

Managed service market?

Analysts forecast that worldwide IT spend in 2013 will be $2.1 trillion with an annual growth rate of 6% (CAGR). Most of this will be spending for equipment being installed within the enterprise datacenter.

This being said, when you talk to CIOs of the Fortune 1000 or of the Global 2000, you will find out that many (if not most) have initiated a datacenter consolidation project, with the end-goal of moving to a 30%/70% mix of infrastructure under internal management versus outsourced infrastructure.

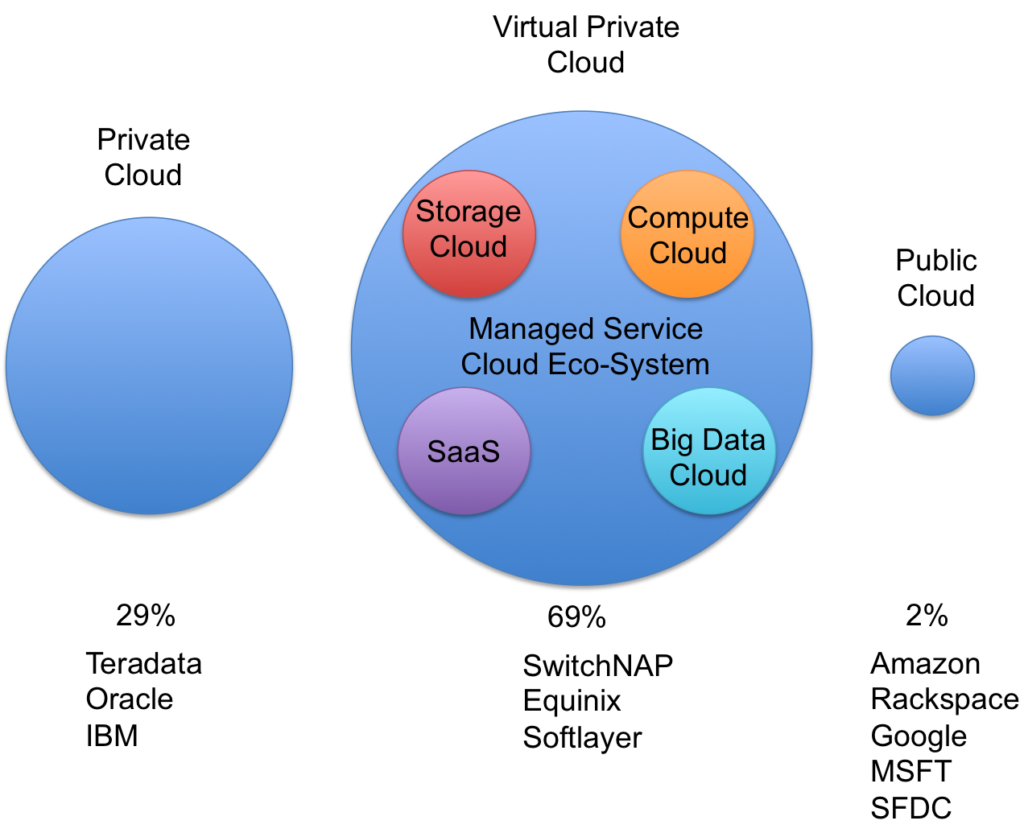

Envision a world where there’s an outsourced managed service market that is larger than on-premise and public cloud markets. It might look something like this:

Platform vendors like Teradata, Oracle, and IBM continue to own the on-premise market, servicing Fortune 1000. Public cloud providers like Amazon, Rackspace, and soon Google Compute own long-tail deployments supporting smaller companies.

And then there is the emerging market of cloud services which live in trusted data centers like Equinix, Digital Reality, Telx, Savvis, Terremark, InterNAP, SwitchNAP, and SoftLayer.

When you decide to outsource to a third party datacenter partner like those mentioned above, you are offered an instant menu of service providers who make up a New Cloud Ecosystem.

Why is this important? Because as a “tenant” in your trusted outsourced datacenter, you have a plethora of cloud services who have launched within the same data center….right where your data lives. These cloud providers range from infrastructure clouds like Amazon’s EC2, or cloud storage, disaster recovery and high availability services, and more.

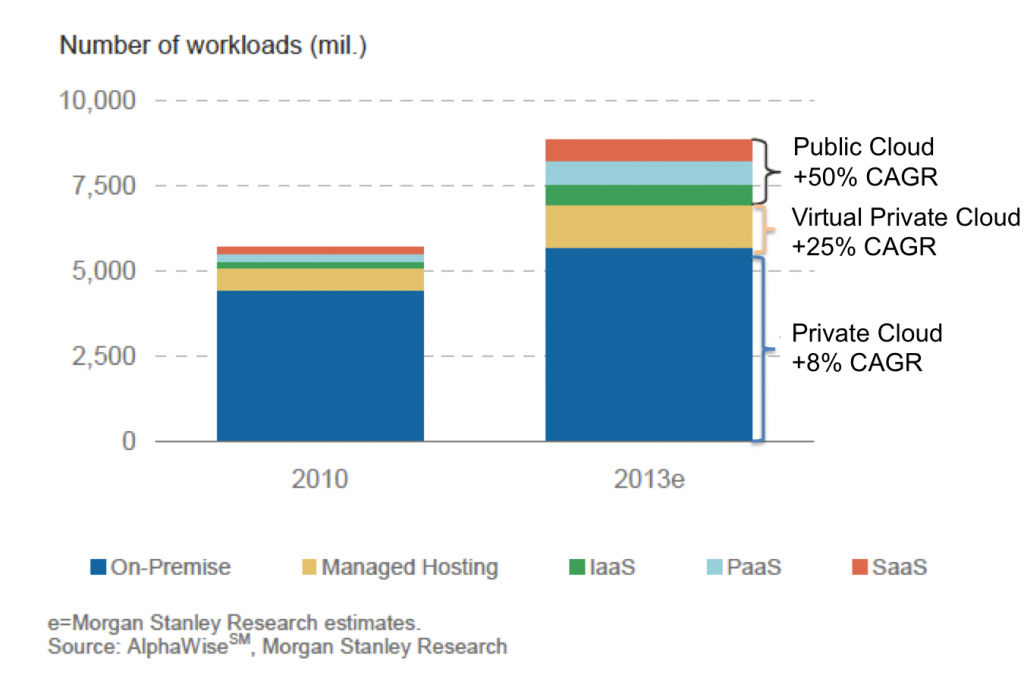

Morgan Stanley classified the size of the 2013 cloud service market across three main categories:

Morgan Stanley classified the size of the 2013 cloud service market across three main categories:

- Private Cloud (8% CAGR)

- Virtual Private Cloud (25% CAGR)

- Public Cloud (50% CAGR)

Public Cloud, although small, is growing the fastest at 50%. The on-premise infrastructure market grows at 8%…..and in between is the Virtual Private Cloud in third party datacenters growing at 25%.

If public cloud is too risky while on-premise being outsourced due to economics, I think the “white space” is this emerging market in the middle…the New Cloud Ecosystem.

Where does your data infrastructure live?

Related posts:

Era of Analytic Applications – Part 1

Era of Analytic Applications – Part 2

Big Data’s Fourth Dimension – Time

The Data Era – Moving from 1.0 to 2.0

3 thoughts on “New Cloud Ecosystem”

Comments are closed.