Big Data Predictions for 2013

Data-Driven Applications – the Big Data theme for 2013

My prediction for 2013 is that competitive advantage will translate into enterprises using sophisticated Big Data analytics to create a new breed of applications – Data-Driven Applications, or also referred to as Intelligent Applications.

“It’s more than just insights from MapReduce”, a CIO from a fortune 100 told me, “It’s about using data to make our customer touch points more engaging, more interactive, more data-driven.”

So when you hear about “Big Data solutions”, you need to translate that into an emerging category and era of “Intelligent Applications”. At the end of the day, it’s not about people pouring through petabytes of data. It’s actually about how one turns the data into revenue (or profits).

This means that you MUST:

- Start with the business problem first (preferably one with revenue upside versus cost savings)

- Determine which data elements you can leverage AFTER #1

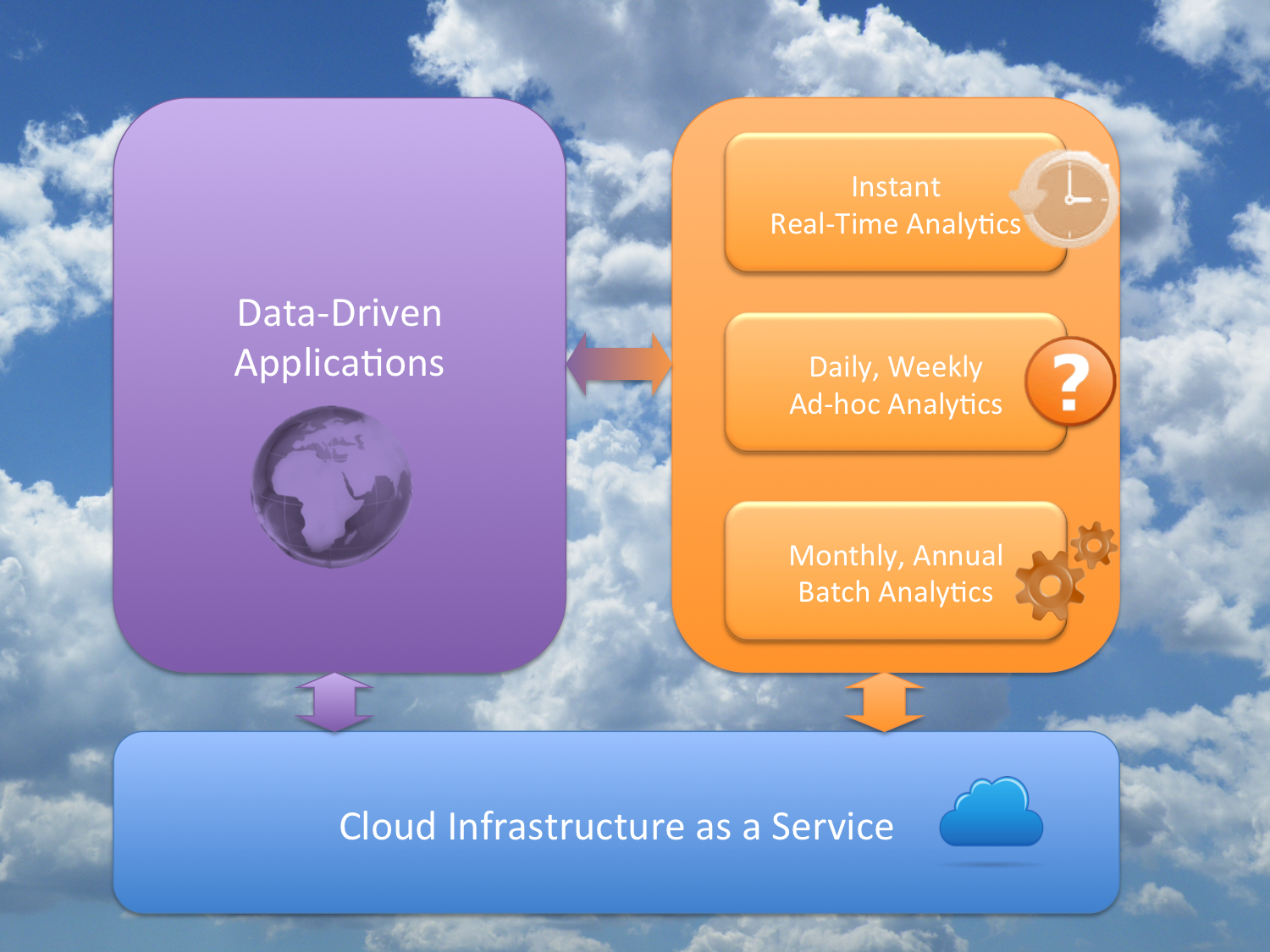

- Define a three-tier data analytic architecture (as shown above)

Which Big Data market segments will grow the fastest in 2013?

Morgan Stanley named the top ten as follows:

- Healthcare

- Entertainment

- Com/Media

- Manufacturing

- Financial

- Business Services

- Transportation

- Web Tech

- Distribution

- Engineering

Many have predicted which Industry is the most attractive (see McKinsey’s Quarterly for another). I personally like Ad-Tech and Financial Services for verticals….followed by Information Management , Health (if you can partner to speed up sales cycles), and Communications.

But what about market segments by technology?

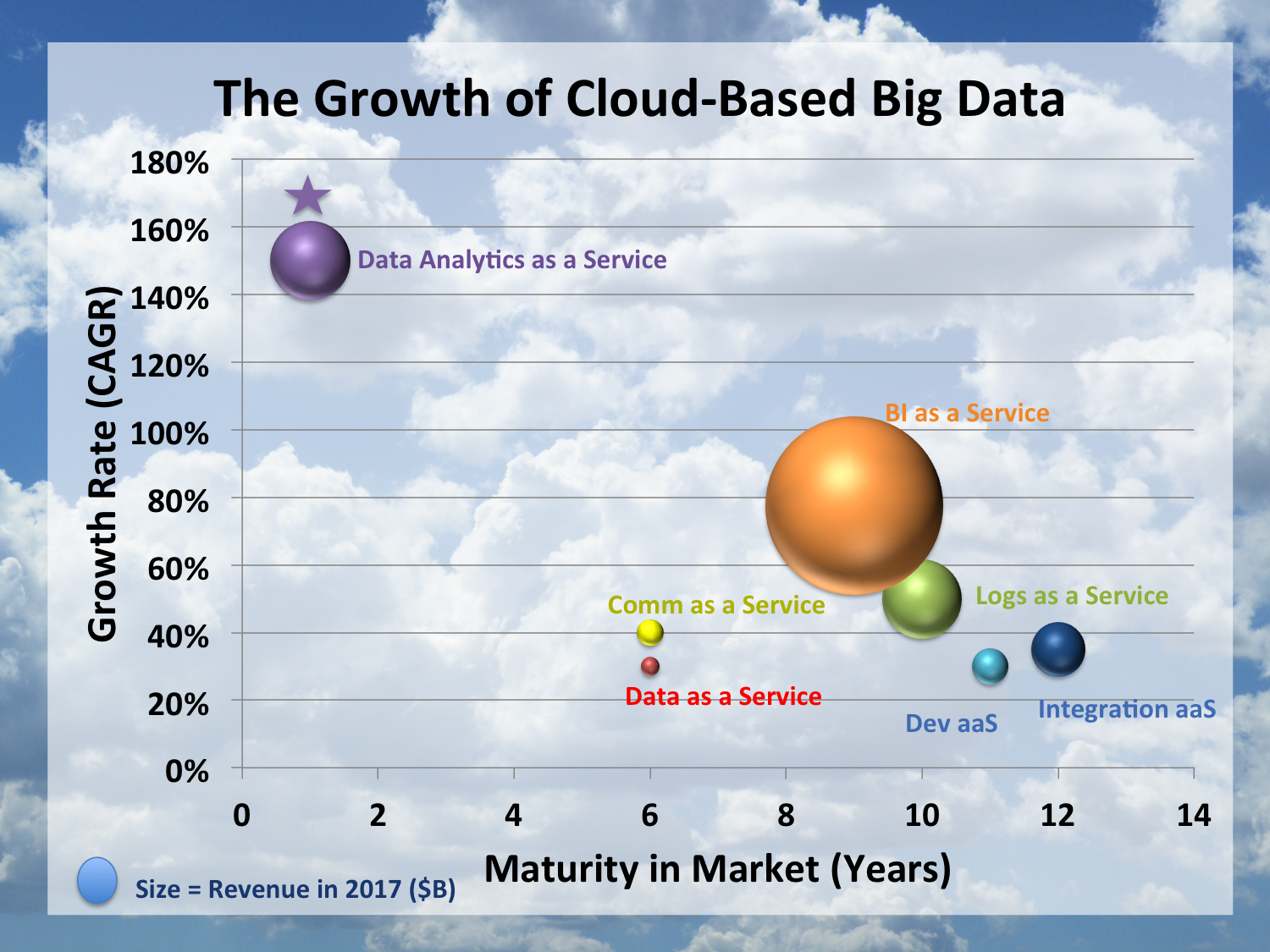

I predict, as shown above, that Data Analytics as a Service (or also referred to as Big Data as a Service (BDaaS)) will have the highest growth (obviously building from a small base in revenue given its level of maturity). Business Intelligence as a Service is the next high-growth segment, given the need for easier ways to present and visualize data, followed by Logging as a Service.

But don’t take my word for this….my data comes from prominent research organizations. I’m just compiling and presenting their data in a slightly new way.

What challenges will end-user organizations struggle with the most in 2013?

End-users will continue to struggle with making sense out of the many technologies available. Is it EMC Greenplum connected to EMC Hadoop? Is it Cloudera Impala + Hadoop? Is it AsterData + Hortonworks? Is it MapR Hbase + HDFS? I think one thing is definite….you have lots of options.

The biggest problem will be whether they are actually satisfying the needs of the business problem. Here are my leading predictions for end-user organizations:

- End users just want to solve problems, but will continue to fight IT over who owns the platform powering their much-needed data-driven applications

- Ultimately, end-users will be forced to chase “shinny objects” because IT groups will persuade them to wait for the “technology bake-offs” around the Big Data platform soon to be launched (24 months from now)

- In the end, many organizations will fail at creating value from Big Data due to a lack of focus on business problems, time-to-market, and in some cases the wrong technology choice

What are some of the key technologies that will dominate the Big Data market in 2013?

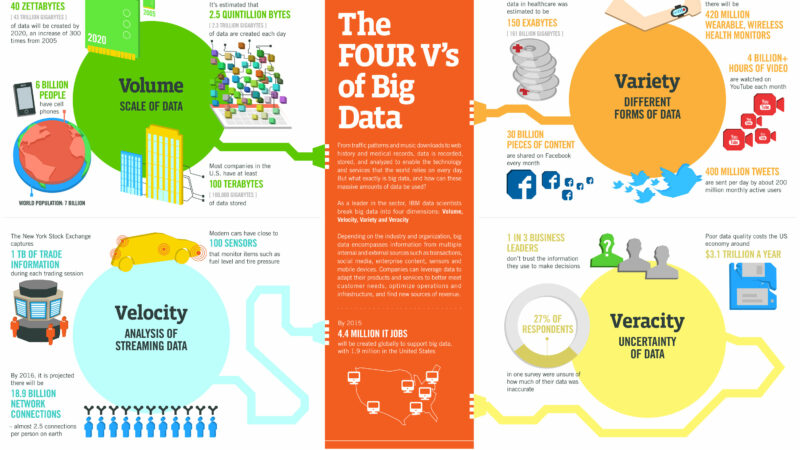

So many equate Big Data with Hadoop. But as you begin to see with announcements like Impala from Cloudera, it’s more than just Hadoop. It’s about servicing all the application response time requirements. It’s about volume, velocity, and variety but also time-to-value with your data analytics.

My prediction for 2013 is that you will need the following technology components:

- Real-time stream processing

- Ad-hoc analytics (see NoSQL and NewSQL data stores)

- Batch Analytics

Not one, but all three!

What steps can customers take to maximize competitive advantage with Big Data in 2013?

Competitive advantage is ALL about time-to-market. I have no doubt that every Global 2000 company will launch their Big Data initiatives in 2013. The question is when they will turn those initiatives into additional revenue…how long will it take from the time that they hire Accenture, CSC, Capgemini, IBM or the like to implement their Big Data strategies, to launching an intelligent application?

My prediction for 2013:

Cloud will become a large part of big data deployment – established by a new cloud ecosystem.

This will be driven by the need for time-to-market and ultimately, competitive advantage. Cloud usually lags any disruption made behind the firewall….by at least 12 months. In the case of Big Data, the launch of Apache 1.0 in December of 2011 basically makes 2013 the year for Cloud-based Big Data.

That being said, large volumes of data, privacy and public cloud are not usually mentioned in the same paragraph by IT in a Global 2000 enterprise. That’s why we’re going to see elastic big data clouds behind the firewall and within trusted third party data center providers.

Related posts:

Era of Analytic Applications – Part 1

Era of Analytic Applications – Part 2

Big Data’s Fourth Dimension – Time

The Data Era – Moving from 1.0 to 2.0

8 thoughts on “Big Data Predictions for 2013”

Comments are closed.