Cloud Orchestration & Management

Cloud orchestration and management has roots which date back to ‘automation’ framework days of the ASP. The two companies which really defined the segment were Breakaway Solutions (aka BladeLogic) and Loudcloud (aka Opsware).

Cloud orchestration and management has roots which date back to ‘automation’ framework days of the ASP. The two companies which really defined the segment were Breakaway Solutions (aka BladeLogic) and Loudcloud (aka Opsware).

During the dot-com boom, Breakaway employed Dev Ittycheria and Vijay Manwani, and Loudcloud was the led by Marc Andreessen. These two groups identified the bottleneck that has defined the category today – namely, the labor-intensive process to get x86 servers off a truck and provision them from the bare metal with the operating system and applications they would need to run in production. Breakaway/BladeLogic (now owned by BMC) and Loudcloud/Opsware (now owned by HP) weren’t the only provisioning automation ventures. Canadian company Think Dynamics was acquired by IBM to form the basis for its Tivoli Provisioning Manager.

Categories

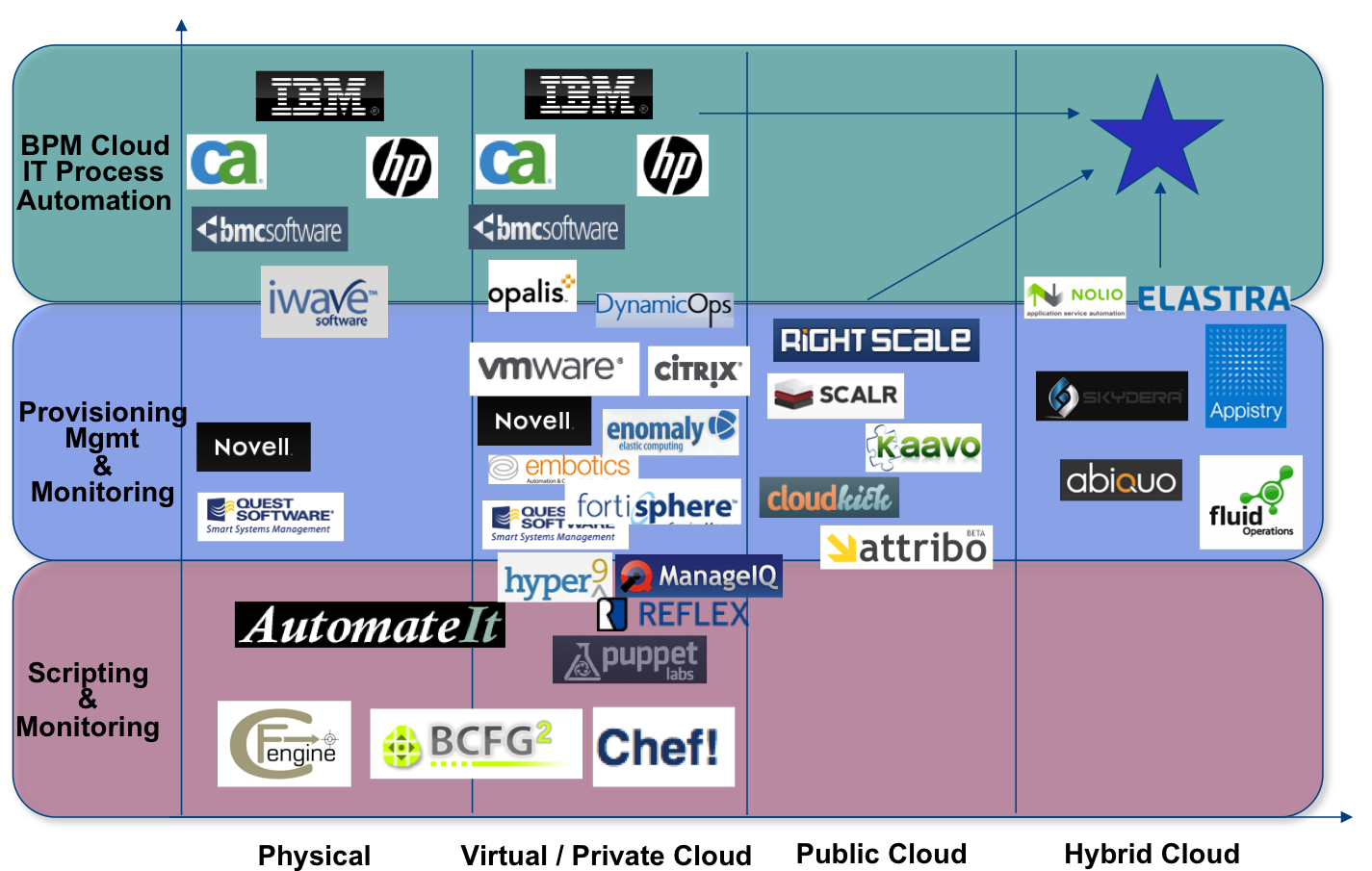

There are many ways to segment the market of orchestration/management. Above is a graphic I created back in January, 2010. A lot has changed since then, but it still provides a view of the market based on two factors:

- The level of resource automation

- The resource delivery model

First caveat is that all lines are blurring as vendors race to the upper right quadrant, allowing enterprises to automate the most complex IT orchestration/management steps, and cover all delivery models/configuration – namely, a complex hybrid cloud.

Second caveat is that a whole new list of vendors have emerged to provide “cloud-in-a-box” solutions, enabling enterprises to build, orchestrate, and manage their own private clouds (with hybrid connectors).

Scripting based Solutions

The three leaders in this space include:

- Opscode Chef: an open source project that bills itself as infrastructure automation for the masses. Using the Chef framework, customers write source code describing how every part of their infrastructure should be built.

- Puppet Labs: an open source server automation framework that is popping up in a variety of internal and hybrid cloud infrastructures, including those at big customers like Google, the New York Stock Exchange, Barclays Capital and Stanford University.

- Cfengine: aims to make heterogeneous datacenters capable of self-repair. It includes a policy-based description language, change management, and the ability to monitor disk and system performance.

Basic Lightweight Virtual Machine Management Solutions

Then there are the many virtual machine managers, which simply spin up, monitor, pause, delete VMs. These “tools” came on the scene first, and then evolved into more full-scale management platforms. Most VM managers also were targeted for private cloud deployments of Xen and the like.

Public-Cloud Management Solutions

Offerings specifically geared towards public clouds, namely Amazon also came on the scene. These solutions also evolved to add in private cloud connectors to support hybrid configurations.

- RightScale

- Scalr

- Enstratus

- Kaavo

- Cloudkick (Rackspace)

Not to mention one of my favorite startups (which is long overdue in launching its service), Skydera.

Infrastructure as a Service Private/Hybrid Cloud Solutions

Then there are complete deployment stacks….with more than just the management component. These include a complete framework required to deliver the cloud solution. When looking at the landscape of private cloud “stacks”, the list is definitely getting longer. Below is a Forrester study which I found interesting.

I personally believe the players worth mentioning in the space include (in no particular order) include:

- Nimbula

- Eucalyptus

- Cloud.com (now Citrix)

- Enomaly

- Surgient (Quest)

- Abiquo

- OpenStack

- RedHat CloudForms

And how could I forget one of my personal favorites (in a list of very few ‘upcomers’), StackIQ.

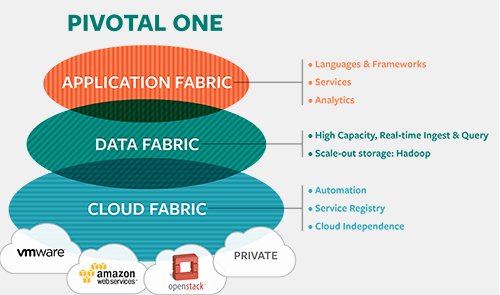

Platform as a Service Cloud Solutions (Private/Public/Hybrid)

These solutions are geared to adding another layer on top of private IaaS services, namely a suite of application-centric web services supporting the AppDev team. This category includes a list of both public and private cloud PaaS offerings:

- Markara/RedHat (Private)

- Oracle Cloud (Private)

- VMware CloudFoundry (Private)

- Gigaspaces (Private)

- dotcloud (Public)

- phpFog (Public)

- Google App Engine (Public)

- Heroku/Force – Salesforce.com (Public)

- Azure (Public)

- Beanstalk – Amazon (Public)

- EngineYard (Public)

And then there are the “System Management based Solutions” who I categorize as the “Incumbents”. See below.

The Incumbents

The incumbents in the “system management” industry (and usually the group that lags behind the true innovators when a transformation is made) are:

- BMC BladeLogic

- CA Spectrum Automation Manager

- IBM Tivoli (TPM and TSAM)

- HP Server Automation Software

- Novell Platespin

- Quest Vizioncore

- Microsoft Opalis

- VMware vCloud Director

- Citrix Cloud.com

- RedHat Enterprise Virtualization Manager

- CISCO newScale

- Platform Computing ISF

All these providers fit in the cloud orchestration and management space. However, as you can imagine their solutions are heavy and based on legacy source-code. Most enterprises view the usability of the incumbent solutions as poor, and are, thus, looking to the startups to provide simpler, faster, and cheaper solutions.

Customer Requirements & Spending Patterns

The market is evolving extremely fast. When I view the customer base I, of course, still view requirements and spending patterns based on customer profile/segment – Small, Medium, and Large enterprises. The requirements and patterns differ quite a bit depending on the customer profile.

Small Enterprises

The emerging companies are all looking to IaaS companies like Amazon, Rackspace, and GoGrid for their on-demand IT. These are companies in the 1-5,000 employee range (with up to 100 x86 physical servers) and do or are considering an “all-public” cloud service model. The requirements are less stringent in terms of SLA, and higher on price, ease-of-use, and time-to-market.

In fact, you will also see these companies using Azure, Google App Engine, Engine Yard, and new players like phpFog, dotcloud, and other Platforms as a Service to further accelerate time-to-market.

Medium Enterprises

Established companies of 5,000 to 20,000 employees (with up to 500 x86 physical servers) and they begin to feel that their IT is part of their core competency (providing certain tricks to improve cost-performance). This group will use some public cloud services and are the largest segment of private cloud solutions.

Their requirements are stringent on SLA, but still at a competitive price (due to the lack of economies when comparing to the Large Enterprise competition).

Large Enterprises

The 20,000+ employee organizations (Fortune 1000) have thousands of datacenter servers. IT is a core competency. CIOs here are focused on containing expense (which is on average 5% of revenue), but the future focus of the IT organization becomes agility. The cost savings here are found through application development efficiencies, rather than IT infrastructure cost reduction.

Public cloud is for “pet projects” and the idea of hybrid cloud is considered in the context of HA/DR and Burst applications.

Cloud Management An Afterthought?

Not a chance. No matter what level you are playing, the complexities of virtual machine management are well known. Thus, people are looking to vendors ahead of time to understand their requirements.

Cloud Management Software Spend

The last time I spoke with IDC analysts, the Systems Management Software vendors were growing revenue at around 9% annually (but working from a large base of over $13B). The Virtual Machine Management Software vendors were growing at around 13% annually (working from only $1.4B). And finally, the new categories of Application Automation Software were perceived to be growing at 19% (because the category was just forming and difficult to quantify).

In a 2010 study on the cloud systems management software market (Worldwide Cloud Systems Management Software Forecast and Trends: 2010-2015), IDC forecast that organizations would be spending $2.5 billion in 2015 on managing a hybrid mix of public cloud, private cloud and non-cloud IT resources.

Demand for cloud systems management software will ramp now that cloud adoption has hit a tipping point (per Mary Johnston Turner, research director at Enterprise System Management Software). As cloud adoption becomes mainstream, the market will increase by a 45.5% compound annual growth rate between 2010 and 2015, she added.

In 2010, 70% of worldwide cloud system management software purchases were deployed in private cloud environments, with the Americas representing 63% of the worldwide market last year.

Hello Jim! Interesting article, but you need to check out DynamicOps. Lots of updates since the last time you checked us out and they put us solidly in the upper right corner of your grid.

Great Reference Article, when you get around to updating it again – Check out ActiveState’s Stackato Platform-as-a-Service for Private PaaS deployments on any Cloud see: http://activestate.com/stackato for all the details