Dirty Little Secret About VMware’s Market Penetration

Paul Maritz’ presentation was well timed today. Or should I say that the Citrix announcement around the acquisition of cloud.com was well-timed. In either case, things seem to be heating up in the virtualization/cloud arena (see blurb from GigaOm here).

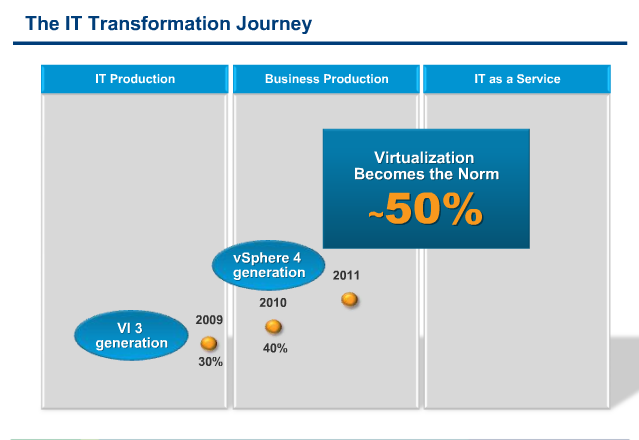

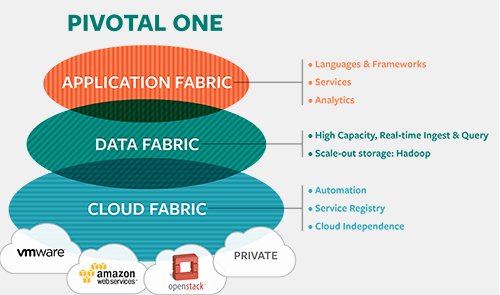

The new Cloud Infrastructure Suite, reviewed by Maritz and Herrod today, outlines how VMware plans on helping enterprises move from “IT Production” to “Business Production” and finally to “IT as a Service”. [Side question….what happened to “Application as a Service” or the initiatives behind VMware’s application acquisitions and the underlining PaaS strategy? Today’s presentation seems a lot like the ‘old story’, albeit tightened up a bit.]

During Paul’s presentation he said, “The market has fully embraced virtualization as a key transformative technology at the heart of the next era of computing,” as he referred to the fact that about 50% of datacenter workloads (x86 workloads) were predicted to be virtualized by the end of 2011.

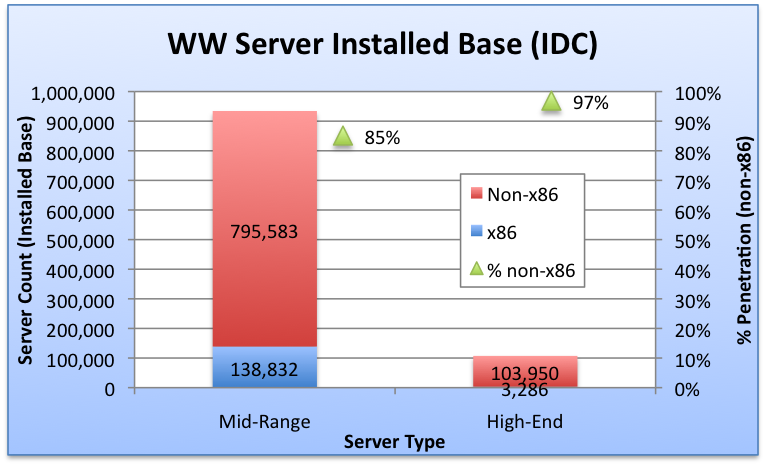

Now here’s where I question (or analyze) the numbers a bit. I’m not necessarily debating whether the number of the virtualized worldwide workloads and associated servers are 50% or less (or whether that number will continue to increase over time), but rather I’d question the breakdown of those workloads/servers. For example, how many of them consist of the mission-critical, mid-range or high-end servers in the datacenter….versus desktop or departmental or volume servers?

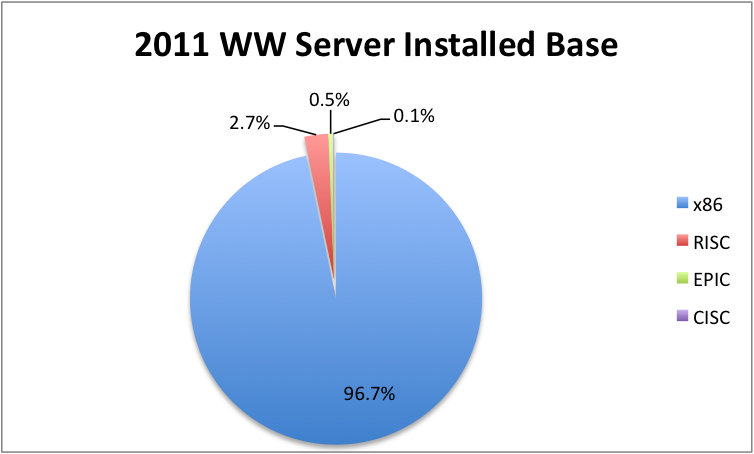

If we look at Fortune 1000 enterprises and their datacenter platforms, my experience has been that most (if not all) are still using IBM mainframes with AIX and Sun with Solaris (alright, that may be overstating things…but I got your attention). So, don’t take my word on this. My exposure to many CIOs at various large enterprises definitely could be considered statistically insignificant. Lets look at the analysts which Paul quoted during his presentation today.

Seems that at first glance of this data from IDC that VMware is, indeed, well positioned by focusing on virtualized x86 platforms. However, if we peel back the onion a little, we’ll find that IDC’s report details the breakdown for mid and high-end servers with associated % of overall. Interesting to see that non-x86 is 85% and 97% of overall installed base for mid and high-end servers, respectively.

Does this support the thesis that larger enterprises who are using mid-range and high-end servers for mission-critical datacenter applications are still using non-x86 (and, thus non-VMware) platforms? Hmmm…..are datacenter architects still chanting, “Long live LPARs and Zones!” ?? I would think that Paul’s answer to this is simply, “It’s just a matter of time.” 😉

Hi Jim,

I think your analysis is thoughtful and truthfully the absolute numbers are probably debatable depending on which analyst or study you look at. But I think the overall point of the journey/generation slide is to showcase that the winds are blowing in the direction of more VMware and not less. Virtualized workloads as a percent of the universe of workloads (however you define the universe) is an ever increasing metric.

That metric is of particular significance since one of the key goals of this launch was to enable more of this universe to be deployed in a virtual environment with confidence.

IDC numbers vary widely – wonder how they arrive at a ‘projection’. Take the case of ‘worldwide installed server base’.

If you see # total server units (installed base) say for the yr 2012 in an IDC report dated 2008 http://h18000.www1.hp.com/products/servers/management/216301.pdf – figure 1 – the number is ~42million units. Now if you see anotehr one dated 2010, http://www.hds.com/assets/pdf/hitachi-new-business-initiative-is-efficiency-report.pdf figure 1 shows server installed base (2003-2013) and now for the yr 2012 the number of installed server base is ~82 million units. Again look at the report http://www.oracle.com/us/products/servers-storage/servers/x86/idc-x86-rack-servers-306298.pdf (2011) and the same number for yr 2012 is put at ~28m units. The first report is focussed on HP, next on Hitachi and third on Oracle. So worldwide server installed base numbers vary widely depending on their vendor focus (data) and the kind of mid-low-high end ranges that are incorporated/ignored as you rightly pointed out.

Agreed Murthy. I wonder though….how hard virtualizing the second 50% of x86 workloads will be….and, how long it will take to migrate the mission-critical workloads off of non-x86. That’s the second $2B question for Paul and family over there at VMware. My guess is that there needs to be an even higher dose of “enterprise class” virtualization (e.g. additional security, etc.) with a simple AIX and Solaris migration plan.

It’s tough….I generally gather the analysts most recent report data and use it for general trends….using them for absolutes (e.g. for internal financial models) is risky. In that case, a bottoms up (rather than % of tops down) is better.