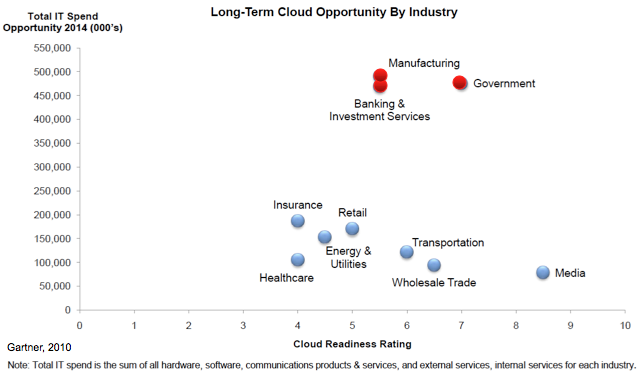

Government and Manufacturing will lead in Public Cloud (SaaS)

Just as I predicted that the Financial vertical will lead in private cloud (see this post), I think Government and Manufacturing will lead in the adoption of Public Cloud as it applies to the larger spenders….specifically, the use of SaaS applications.

The Government and Cloud

You have to just read about how the Fed (with the vision led by Chief Information Officer Vivek Kundra) is creating an important new mechanism for granting government-wide approval for agency cloud computing applications that can then be adopted by other agencies…..to understand why the GOV is an advocate. You can read about the government’s activities here, and see details of the government’s plans here, and a presentation from Vivek Kundra here.

U.S. state and local governments will spend $54.6 billion on traditional technology goods and services in 2010. According to a 2010 survey by the National Association of State Chief Information Officers (NASCIO), cloud computing is the second most popular technology priority in state and local governments. Given the depth and breadth of the current economic downturn and budgetary shortfalls, the interest in cloud-based services among state and local government organizations is very high.

The initial interest is driven in part by the perceived lower costs and reduced risk of technology deployment associated with cloud-based services, particularly during the first three years. The most easily addressable aspect of cloud computing for state and local governments is SaaS. Given the ongoing budgetary shortfalls across the nation, SaaS provides an opportunity for these organizations to drive modernization efforts without large-scale capital expenditure. Moreover, given the broad portfolio of software applications, state and local governments can dabble with SaaS in non-mission-critical areas (e.g., recruitment, collaboration and testing) to become more comfortable with the model.

The positioning and attractiveness of cloud varies by the size of the user (Tiers 1 through 5), orientation of the agency (core versus niche), and type of application (mission-critical versus traditional). Smaller jurisdictions, niche agencies or traditional application areas are more applicable to SaaS implementations.

Manufacturing and Cloud

Its clear when talking to leading CIOs in manufacturing (like David Smoley, CIO Flextronics) you quickly realize that a global manufacturing enterprise has many offices all around the world which can leverage the benefits of the usage-based and on-demand model. It’s a “natural choice”.

When you have analysts like IDC forecasting that SaaS revenue will grow at just over five times the growth rate for traditional packaged software from 2009 to 2014, it’s not hard to appreciate that it must be driven by more than the long-tail of small and medium enterprises. IDC expects that by 2012, less than 15% of net-new software firms coming to market will ship a packaged product (CD); by 2014, about 34% of all new business software purchases will be consumed via SaaS, and SaaS delivery will constitute about 14.5% of worldwide software spending across all primary markets.

For manufacturing, an industry that spent over $416B on IT alone in 2009 (according to Gartner), are giving the most serious consideration to software as a service (SaaS) in the near term; 24% of manufacturing firms Gartner surveyed in mid-2010 are “extremely likely to contract with an external service provider” for SaaS during the next two years, versus 18% for infrastructure as a service (IaaS); and 19% for business process as a service (BPaaS). Outside of communications and collaboration and sales force automation solutions, adoption at large enterprises has primarily been driven by individual divisions and departments.

Other related articles:

- Cloud Prophecies: The Cloud Era

- SaaS offerings will dominate market (greater value with the end-user application)

- Private Cloud Will Drive the Bulk of Revenue in the datacenter (sorry Amazon)

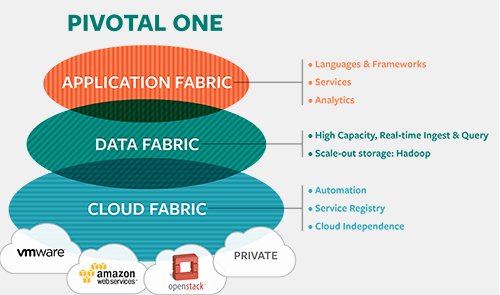

- Platform as a Service = Application Focus = $True Value (IaaS is dead)

- Financial will drive commercial innovation in Private Cloud

- Government and Manufacturing will lead in Public Cloud (SaaS)

- Power of IT shifts to Application Developers

- System Integrators turn into Managed Service Providers (with Cloud)

- SIs are the gateway into large enterprise for new cloud vendors

- Open (driving more commodity) will become key For the Channel

4 thoughts on “Government and Manufacturing will lead in Public Cloud (SaaS)”

Comments are closed.