System Integrators turn into Managed Service Providers (with Cloud)

What is Managed Services?

A managed service provider (MSP) provides delivery and management of network-based services, applications, and equipment to enterprises, residences, or other service providers. Managed services is offered by hosting companies or access providers that offer services that can include fully outsourced network management arrangements, including advanced features like IP telephony, messaging and call center, virtual private network (VPNs), managed firewalls, and monitoring/reporting of network servers. Most of these services can be performed from outside a company’s internal network with a special emphasis placed on integration and certification of Internet security for applications and content. MSPs serve as outsourcing agents for companies, especially other service providers like ISPs, that don’t have the resources to constantly upgrade or maintain faster and faster computer networks.

A managed service provider (MSP) provides delivery and management of network-based services, applications, and equipment to enterprises, residences, or other service providers. Managed services is offered by hosting companies or access providers that offer services that can include fully outsourced network management arrangements, including advanced features like IP telephony, messaging and call center, virtual private network (VPNs), managed firewalls, and monitoring/reporting of network servers. Most of these services can be performed from outside a company’s internal network with a special emphasis placed on integration and certification of Internet security for applications and content. MSPs serve as outsourcing agents for companies, especially other service providers like ISPs, that don’t have the resources to constantly upgrade or maintain faster and faster computer networks.

In addition to such basic communication service as leased line wide area network (WAN) and frame relay service, an MSP can manage and integrate a range of activities associated with enterprise networks. The range of outsourcing services includes basic transport and access, managed premises, Web hosting, VPN, unified messaging, video networking, or other more sophisticated services. The market for managed services is forecast to grow about 20 percent annually, according to The Yankee Group, due largely to the need for enterprises to be more flexible and timely in getting to market and communicating with customers. Nortel Networks, Lucent, and Checkpoint are three of the best-known companies that provide MSP services.

Managed service providers sometimes are referred to as management service providers, also manage information technology services for companies. However, some industry experts say managed service providers provide a broader range of services than management service providers, which tend to limit themselves to monitoring services for servers, routers, firewalls, and other applications (e.g. Netenrich). Management service providers typically deliver infrastructure management services on a subscription basis, similar to the model used by application service providers (ASPs). They most commonly offer network- and application-monitoring services to e-businesses.

Managed Services and Cloud

As general market trends unfold, Gartner expects that revenue from traditional approaches (hosting/colocation and traditional Data Center Operations) will progressively migrate into utility and cloud-based approaches. More than $10 billion net new business will go to Infrastructure Utilities (IUS) in 2010 through 2012. Hypercompetition, market consolidation, price reductions, and standardization of servicelevel agreements and terms and conditions will continue to affect traditional DCO and hosting relationships.

We’re seeing fast growth in emerging markets. For example, in India the global IT infrastructure market has been projected to be $150 billion and the global market opportunity for remote infrastructure management services has been predicted to reach $70 billion in 2010 (up from $50B in 2009), according to industry association NASSCOM.

A year or two ago, companies like mindSHIFT and Alpheon were easily categorized as managed services providers. But with mindSHIFT’s buyout of Alpheon today you begin to see cloud computing entering the mix. When mindSHIFT merged with Invision in September 2007, the press release clearly described both companies as managed services providers. Fast forward to January 2010, and mindSHIFT now blends cloud into its managed IT services marketing efforts. For instance, today’s mindSHIFT-Alpheon press release states:

mindSHIFT Technologies, the largest provider of IT and cloud services, today announced the acquisition of Alpheon Corporation, a Morrisville, North Carolina-based provider of managed IT services to small and mid-size organizations with a strong vertical presence in the healthcare market.

mindSHIFT will empower Alpheon with more cloud-centric services and virtual desktop integration (VDI) offerings.

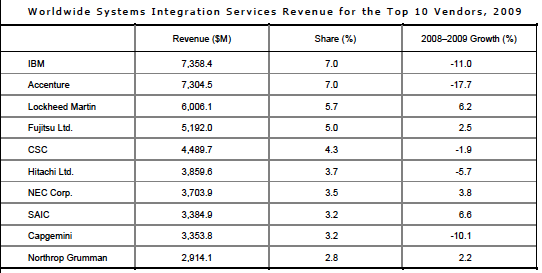

System Integrators Expand Into Cloud With Managed Services

When you look at the core businesses for some of the top SIs around the world, you’ll understand why adding managed services to their portfolio makes sense. Assuming that cloud computing is going to be such a large component of enterprise IT spend, then you can either provide professional services to the providers of Cloud services, or you can become a cloud provider yourself. Why wouldn’t SIs bid on RFPs for building, managing, and evolving cloud infrastructure for Fortune 1000 enterprises?

This trend might be more pronounced for emerging markets including India and China. But I think it applies worldwide. I see events like Wipro’s acquisition of Infocrossing (see article here) as one example of this trend.

Other related articles:

- Cloud Prophecies: The Cloud Era

- SaaS offerings will dominate market (greater value with the end-user application)

- Private Cloud Will Drive the Bulk of Revenue in the datacenter (sorry Amazon)

- Platform as a Service = Application Focus = $True Value (IaaS is dead)

- Financial will drive commercial innovation in Private Cloud

- Government and Manufacturing will lead in Public Cloud (SaaS)

- Power of IT shifts to Application Developers

- System Integrators turn into Managed Service Providers (with Cloud)

- SIs are the gateway into large enterprise for new cloud vendors

- Open (driving more commodity) will become key For the Channel

5 thoughts on “System Integrators turn into Managed Service Providers (with Cloud)”

Comments are closed.