An AI Startup CEO’s Reflection

When I was introduced to Conversica in August 2019, by the Savant Growth partnership, AI was well-understood by both Eric Filipek and his partner Javier Rojas because they had already made their first investment in Conversica back in 2013 (almost 12 years ago now).

Conversica was founded in 2007 by Ben Brigham (then called AutoFerret, starting as a Meta-Search Engine for vehicles) and then it launched its first Sales AI in 2009 (changing its name to AVA.ai). In 2014, it changed its name again to Conversica, a play on the word “conversation” with a brand that promoted the combination of humans and AI to accelerate revenue growth. This coincided with Savant Growth’s private equity investment.

Most of the general public didn’t know what was happening at Google in the AI world back then. But as Conversica obtained its first PE investment (2013) and began to diversify its AI offerings, Deepmind (founded by Demis Hassabis, Shane Legg, and Mustafa Suleyman) was soon acquired by Google (2014); and the Google Brain team (created by Jeff Dean, Andrew Ng, and Greg Corrado) was experimenting on the use of large scale neural nets to improve core products like Search, YouTube, and Ads. When I entered the picture, taking the helm of Conversica, in October 2019, I had a little peek into the AI crystal ball (thanks to a long walk with Ron Bodkin). It was only 2 years after the transformer model was invented by the Google Brain team and introduced via a 2017 paper titled “Attention is All You Need“. The Google DeepMind and Google Brain teams later merged in 2023.

“Oh my god, Eric. This company is MUCH bigger than you think it is.”, was my comment to Filipek back when he asked me to just take a look (summer of 2019). “I already think it’s big.” said Filipek. “It’s the largest investment in our portfolio. But tell me more.”

Here’s what I saw back in August/September of 2019, when I looked at Conversica for the first time. I looked through three lens:

- Digital Transformation continues to accelerate & put pressure on human workforces to automate

- AI with traditional ML/DL is hard

- Operational excellence requires a data-driven approach

Digital Transformation

When I ran the America’s Digital Apps team at DXC ($1B, 7000 people), we were deploying over 1000 digital transformation projects every year. I knew that companies faced significant challenges when increasing their digital touch with their end-customers. The more digital touch a company created, the more challenges they faced servicing that digital touch, unless automation was increased to offset the human burden from the volume of consumer activity.

It was clear that automation in the back office was already taking off. Back in 2015 when I worked at DXC (then CSC), I had this idea of partnering with the emerging RPA companies: UIPath, Automation Anywhere, Blueprism, Kofax, and Pega. UIPath was just raising their seed funding then.

When I saw Conversica, four years later, I saw even more powerful automation, but in the front office. If UIPath could command hundreds of dollars per AI bot in the back office and create enterprise value of $28B at IPO a little over 5 years after it’s seed round (2015), then Conversica could sell AI bots for thousands of dollars in the front office and achieve even more enterprise value.

The idea of combining the two worlds of front-office and back-office automation intrigued me, creating an end-to-end intelligent automation company. We pitched this idea to PE when we fundraised for our Series D in late 2019 / early 2020.

Artificial Intelligence

Having achieved the fastest growing business within DXC at the helm of Big Data & Analytics (51% YoY, 4Q25, May 2015), we deployed over 700 big data projects annually, giving me a strong view of “AI” well before GenAI.

Half of my $250M line of business was dedicated to commercial AI use cases (engaging the Fortune 1000), and half to government AI use cases (engaging all the 3-letter agencies associated with protecting our homeland).

What I learned throughout my career with machine learning, deep learning, and now AI, was that model building, deployment, and maintenance is hard. I knew that the minute you trained a model on the data it uses to take action, the model immediately started to decay. I knew that keeping models accurate was a required discipline.

The fact that Conversica had built a ML/DL pipeline that used all customer data to benefit every single account intrigued me. What also intrigued me was Conversica’s ability to achieve a 98% accuracy level for the combination of interpreting the end-user AND taking the right next best action based upon that interpretation. The business had perfected the method by which the human-in-the-loop was deployed to maintain this high accuracy level, all in a scalable way.

I knew, based on my many “walk and talks” with people in the Google CTO office responsible for Applied AI, that something even more amazing was coming. With Conversica’s domain experience in ML/DL at scale, we could add in GenAI and truly advance the state of the art.

This was just at the time when OpenAI had just moved from a non-profit to a capped-profit model in order to raise the required capital to build AGI. The company was still < 200 people and GPT1 was still the foundational breakthrough, with a small version of GPT2 at the same parameter size (117M), all right when I started looking at Conversica.

But based on Google’s PaLM (now Gemini) the people I spoke to had big sights on how to evolve this technology beyond search, recommendations, and ads (e.g. healthcare, etc). Google’s BERT transformer was open sourced and available to us. So we started there, launching our first GenAI product in March 2020. We believed betting on Google would give us a competitive edge.

Operational Excellence

Two things came to mind when I dug into the business – 1) Profitable growth is hard, and 2) data doesn’t lie. Having just exited Janrain, a PE-backed business, there were many similarities between the two companies, with lots of “low hanging fruit”. For example, we had 23 VPs at a company of about 230 people total, making up >25% of the costs in the business.

The business’ metrics made it clear that the team had achieved success, but through what I refer to as the “VC-backed” growth model vs. the “PE-backed” growth model. Namely, Conversica was growing “at all costs”.

A 40% YoY growth rate was truly impressive. However, every $1 of ARR cost the business $2 to acquire. Now, in my experience the VC-growth model can support unprofitable businesses. But, the PE-growth model is typically focused on profitability.

Conversica was approaching $50M in ARR, which is a great milestone, but it had done so with what I’ll call a lot of “singles”…for the most part:

- Single product offering: Sales AI

- Single customer segment: SMB

- Single industry vertical: Automotive

- Single region: North America

- Single G2M sales model: Inside sales

There is nothing wrong with this, if investors are ok with the heavily capitalized T2D3 growth model (triple, triple, double, double, double), to take a company from start to unicorn status. Again, this model typically requires significant growth capital. It felt like Conversica was actually past its T2D3 at $50M trying to get over $100M within two more years. Sure, in the AI space, this size of ARR with this growth can command significant EV (10-20x ARR). However, the business was missing one thing to continue to fuel this model – capital, and it’s growth would need to shift from growing at all costs to a profitable growth model.

From an Operational Excellence perspective, the team had not run the business with a tight control on metrics typically important to Private Equity investors, at least with the larger, more successful funds.

This model would have been fine, if the company raised $150M of capital it had targeted before COVID hit. IF our Series D, had concluded with $150M, we might have been able to sustain SMB growth of 40% while adding in mid-market and enterprise into the revenue mix.

Fast forward, when we finally teased out about 400 metrics in the business, there were no places to hide. Now, I’m not advocating that you go to this level of detail, but when you have accurate and near-real-time data, it’s much easier to map out the “from” -> “to” in the business, and drive change.

For us, we had been tasked with maintaining growth, achieving profitability, and reducing our capital raise from $150M to $20M. This drove the team to take unnatural acts from 2020 on.

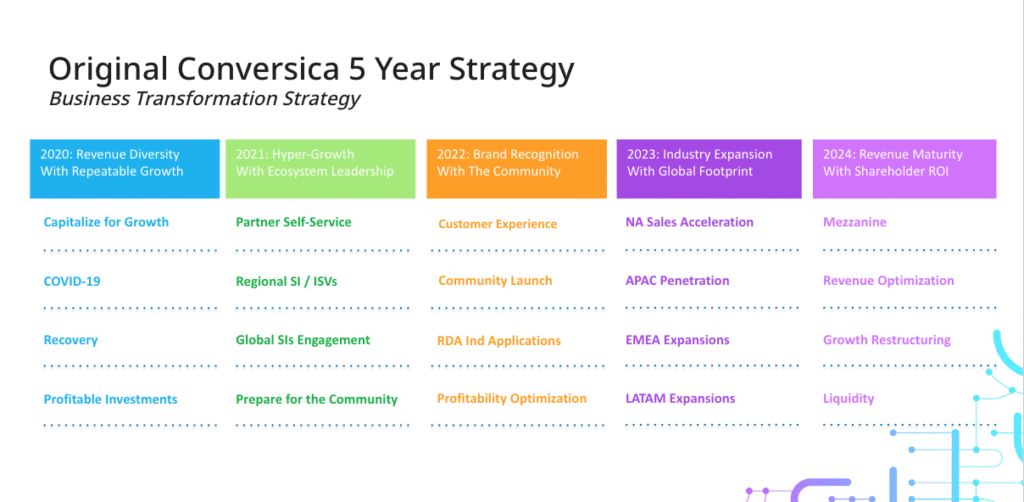

So we set out on a 5-year journey as I show in the following, with many dos and don’ts worth passing on to others.

| Year | Themes | Quarterly Themes |

| 2019 | Leadership |

|

| 2020 | Revenue Diversity |

|

| 2021 | Hyper-Growth w/ Ecosystem Partners |

|

| 2022 | Brand Recognition w/ Community |

|

| 2023 | Industry Expansion Globally w/ Partners |

|

| 2024 | Revenue Maturity & Shareholder ROI |

|

| 2025 | Transition & Handoff |

|

23 quarters (5.5 years), 422 “design thinking” workshops, 171 discrete playbooks, all applied over 14 discrete areas of the business as well as across the leadership team. Wow.

Strategy isn’t built in slides. It’s forged in hard conversations, late-night pivots, and the messy middle of execution. Every bold move we made as a company lived or died by the strength of our executive team. What follows isn’t just my perspective—it’s the collective experience of those who were in the trenches. The functional leaders who owned the inflection points. Who navigated the trials, learned from the misfires, and helped turn strategy into motion. This is what transformation really looks like—function by function, leader by leader, decision by decision.

- Executive Team Management

- Direct Sales

- Indirect Sales / Channel / Alliances

- Marketing

- Customer Success Management

- Technical / Customer Support

- Professional Services

- Product Management

- R&D

- Cloud Operations / DevSecOps

- Legal / Security / Compliance

- HR / People

- Finance

- International Operations

- Corporate Development

- Board Management