Stop Selling Direct to SMB – A CEO’s COVID Story (Pillar #2)

What? Stop selling directly to SMB? Wait a minute. Conversica was founded based on a single use-case (accelerating sales) for small and medium sized businesses (starting with automotive dealerships). So why would we stop selling directly to SMB when our business and value proposition was born out of this segment?

In my post, “Pillars of Change – A CEO’s COVID Story (Pillar #1)” I spoke about the early analysis we did (pre-COVID), that later fueled the change in our company strategy at Conversica – namely, stop selling directly to SMB.

Lets review the situation, as of 1Q20…

- We had over 1,500 SMB clients

- ACVs for SMB was trending towards $30K

- LTV:CAC was 3.3

- Payback was 14.4 months

- 90% of our SMB clients had month-to-month contract and payment terms

Sounds like a strong position in SMB, right? Excluding the micro-SMB clients, our TAM (total addressable market) is over 250,000 SMB companies, worldwide. That’s $30K x 250K = $7.5B.

OK, we can actually reduce that down to the number of digitally-enabled, which we know will only improve after COVID-19 (if you’re an SMB company and haven’t learned how important being digital is during COVID, you never will).

Pre-COVID, we might have assumed that 25% of SMBs invest in online marketing. That would reduce to a SAM (serviceable market) of over 60K digitally-enabled SMBs. That’s still close to $1.9B in SMB market opportunity!!

So with such a large market opportunity, how could we make a sudden shift away from the segment? Well, the successful change in our 2020 strategy really came down to two painted-picture factors (aka what I believed the company would look like in the future):

- In the future, we would have a strong network of resellers selling directly to SMBs, representing Conversica, driving 50% of our revenue, and

- Our direct sales would be focused on Mid-market and Enterprise clients, where the LTV:CAC and overall enterprise value is the highest.

Lets not forget that I also wanted to accelerate to cash flow break even and profitability in 2020 (fun fact…we were EBITA positive end of April, 2020). So when you add this all up, we HAD TO consider the idea to stop selling directly to SMB client prospects, starting immediately.

Because of our success in this segment, we were NOT getting out of the SMB business altogether. In fact, our new plan has us growing our SMB revenue (not ARR) to over $47M (this is today’s plan of record). So, what was my new plan for the Board back in March? Well, it involved a significant change to how we sourced and serviced this SMB business.

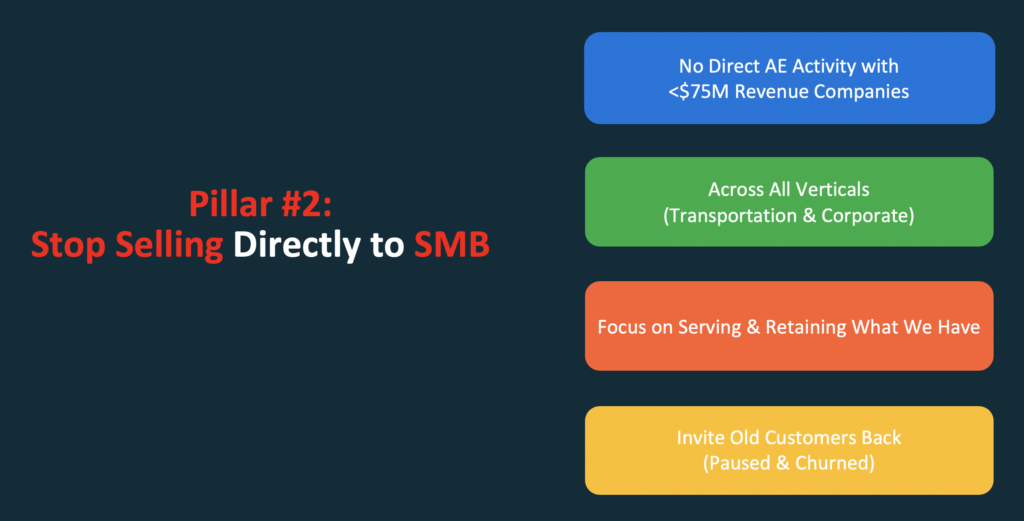

I proposed the following changes to our strategy, to be executed on April 1st:

- No direct selling in 2020 (we would re-engage in direct sales to SMB in 2021)

- 100% indirect reseller network to service new SMB clients in 2020

In hindsight (which is always 20/20 as they say), we couldn’t have been more right in making this strategic move – especially given the circumstances of COVID and its impact on SMB.

But it wouldn’t have been successful without having the resolve to: 1) focus on mid-market and enterprise clients (not segments we were historically good at landing nor expanding); and 2) without executing on an aggressive reseller partner/alliance go-to-market (where we were historically focused on referral).

That leads me to pillars #3 and #4.